While aerial drone attacks on maritime vessels have thus far focused on commercial and naval ships, there is growing concern that quarter-billion dollar-plus superyachts, and the VIPs who own and cruise in them, may be vulnerable.

Similar small unmanned aircraft systems (UASs) used by ambitious paparazzi to photograph the vessels and people of the superyacht scene for more than a decade have proven deadly when weaponized in Ukraine and elsewhere, as The War Zone has frequently chronicled.

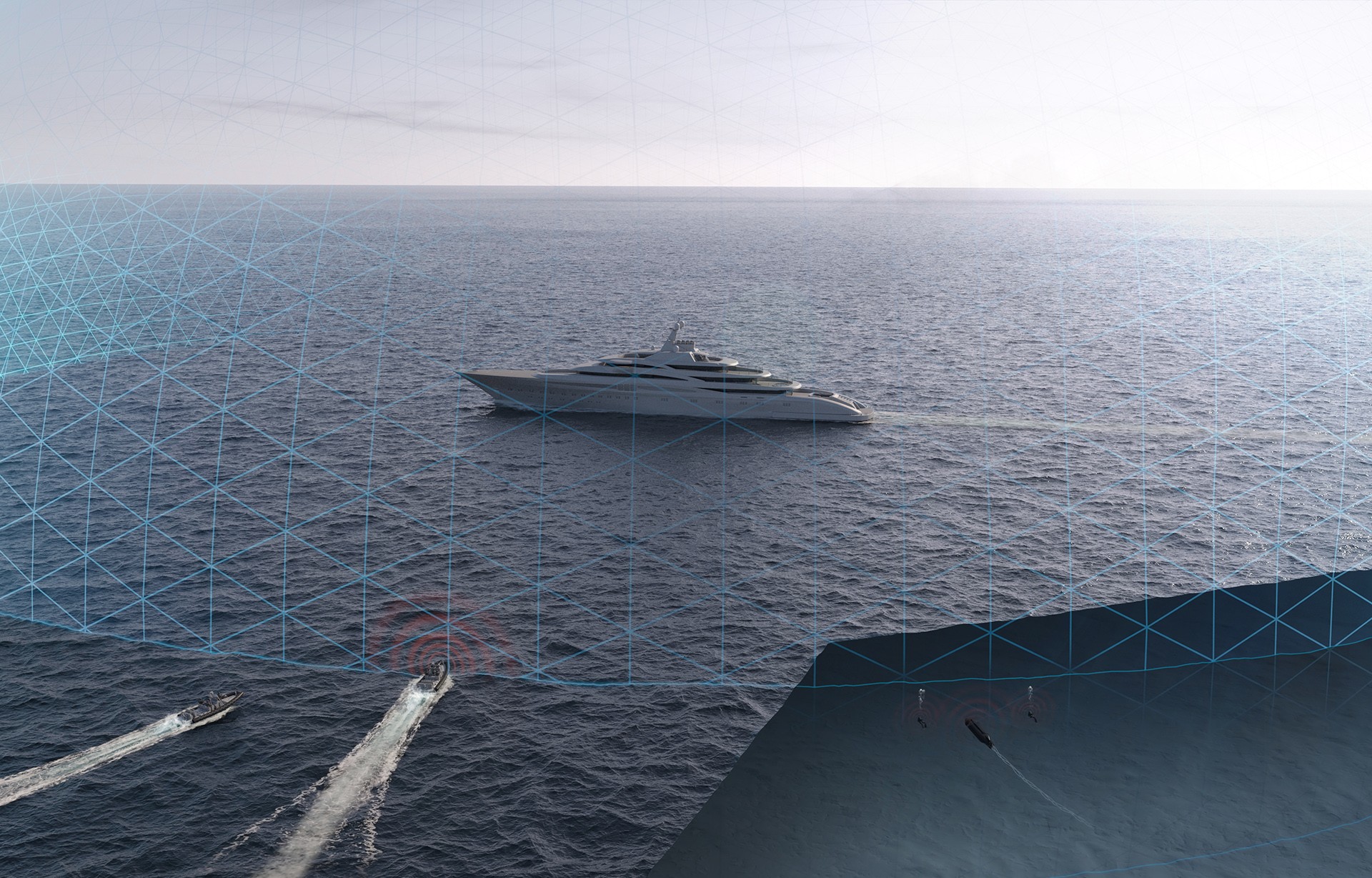

This reality has created a small, but growing market for counter-UAS (CUAS) systems for superyachts. Over the last five years, a number of firms have begun to offer CUAS capabilities for ultra-luxury vessels, including London/Monaco-based MARSS, which recently completed the installation of its NiDAR CUAS system on an undisclosed 400-foot (120m) superyacht and its 230-foot (70m) “support vessel.”

The installation cost approximately $4M and builds upon four previous NiDAR systems integrated by the company on new-build and existing superyachts in 2023. As costly as such systems are, a small but increasing number of owners figure they’re worth it.

Their calculus is set against the broader superyacht business, which is down slightly this year, but that has boomed over the last several years as global wealth has continued to concentrate, and the global pandemic attached new value to both seclusion and seizing pleasure while one can.

According to a feature in The New Yorker, the number of private yachts over 250 feet (76m) in length climbed from less than 10 in 1990 to well over 120 in 2022.

The largest of them (sometimes called megayachts or gigayachts) rival or exceed naval destroyers in length, with hulls longer than 500 feet (152m).

To go with their size, superyachts are owned by people with pull – business moguls, royals, top celebrities, and oligarchs. These people host equally high-profile and some very powerful but lower-profile individuals aboard their lavish vessels. Some of these figures can be major targets. In addition, these yachts have to travel through tough global neighborhoods to reach their destinations, and they are clearly prime targets, even symbolic ones, themselves.

So needless to say, security is already top of mind. This has long been the case in the Middle East where superyachts owned and operated by royal families or governments blur the line between private and state capabilities. The VIP/force protection for some yacht owners in the region has seen military capabilities deployed as part of standard protection.

Lower-profile owners commonly employ highly experienced security teams for their superyachts. Such teams offer direct protection, risk mitigation planning, and the kind of threat assessment expertise that may convince an owner to acquire a counter-drone system.

Privacy Or Protection

MARSS’ end-to-end, detect to defeat CUAS solution is offered for fixed-site land and mobile applications, pairing the firm’s proprietary AI-enabled NiDAR command/control software and user interface with vendor-supplied sensors (radar, electro-optical/thermal), countermeasures, and effectors.

It has been available for several years and gained major market share in the Middle East, according to MARSS Vice President of Business Development Josh Harman. In fact, the company’s NiDAR platform was integrated into the recent joint U.S./Saudi Arabia Red Sands 24.2 CUAS exercise as the central C2 and sensor fusion software in a layered defense.

MARSS’ maritime CUAS features the same NiDAR C2 and sensor fusion but with an important difference. While it employs radar, optical, and passive radio frequency (RF) sensors along with software infused with AI to detect and classify UASs, it does not include any ‘soft-kill’ or kinetic drone-defeat countermeasures.

That’s because such mitigation features aren’t explicitly legal for private vessels, Frederik Giepmans, managing director for MARSS Maritime told TWZ in an interview.

While international maritime conventions like the United Nations Convention on the Law of the Sea (UNCLOS) or the International Convention for the Safety of Life at Sea (SOLAS) currently say little about the permissibility of drone-defeat systems on commercial vessels or yachts, the laws of the respective flag-countries under which they operate generally prohibit passive or active drone defenses on these platforms. Laws within different territorial waters come into play as well.

However, the prohibitions on drone mitigation have not prevented the emergence of a superyacht CUAS market. Giepmans acknowledges that owners are reluctant to discuss the threat of airborne drones to the privacy or safety of their vessels, but they have been quietly buying systems from MARSS, United Kingdom-based Drone Defence, and CACI among others.

MARSS’ maritime counter-drone system can utilize Echodyne radars, Aaronia passive RF sensors, and Current Science Corporation EO/IR cameras to detect small to midsize UAS at ranges out to about 12 miles (20km). MARSS points out that its NiDAR system is sensor agnostic so detection ranges will vary depending on what sensors are installed with the chosen suite.

It’s worth noting that MARSS seeks to offer comprehensive threat awareness for superyachts with its NiDAR 4D suite which, in addition to airborne drones, detects surface and underwater threats (UUVs/divers) using a variety of radar, optical, thermal, and sonar sensors.

NiDAR’s proprietary AI handles UAS classification using video/radar/passive RF behavior pattern recognition, object data points, event history analysis, and other inputs. Once an airborne target is detected and identified, alerts are relayed to the yacht’s crew via the NiDAR user interface.

Responses may include getting owners and guests below deck and into safe interior spaces and notifying local authorities of drone activity. Despite the questionable legality of using drone-defeat systems, jamming or kinetic actions by a yacht with the right equipment are possible.

When pressed, MARSS Maritime’s managing director acknowledged that some owners have acquired active drone-defeat capabilities to go with CUAS detection, though not from MARSS he says.

Simon Rowland, CEO of Veritas International, a United Kingdom-based private security firm that provides ex-military security personnel, cybersecurity, and other technical security services to the luxury yacht market, agrees.

“There are routes to installing the other half of the system, but you’ve got to find the right sort of place. There are export control issues for one, but I imagine there are creative routes to market,” he says.

However, going to such lengths is rare and generally superfluous with respect to current threats, Rowland asserts. For the time being, drone threats to superyachts appear to be limited to threats to privacy, not physical harm. Rowland adds that he doesn’t know of any superyacht that has experienced an aggressive physical threat from airborne drones.

“That’s not to say it hasn’t happened. I’m just not aware of anything. There’s no trend I would say.”

The U.S. Coast Guard apparently hasn’t identified a trend either. In response to a query regarding reports of unwanted drone activity around large yachts, a USCG spokesman offered The War Zone a somewhat cryptic reply.

“The Coast Guard does not have any readily available data on specific ‘unauthorized small UAS’ near large recreational vessels.”

In the often secretive world of superyachts, it can be difficult to glean hidden concerns but both Rowland and Giepmans told The War Zone that in their view there is as yet no collective industry acceptance that airborne drone threats will become a widely standard conversation.

Joshua Hutchinson, managing director at Ambrey, another United Kingdom-based maritime security firm with a focus on commercial shipping, says that when the Houthi threat to shipping in the Red Sea emerged in late 2023, “there was an initial burst of [CUAS system] inquiries, both from commercial shipping and the private yacht market.”

Interest has cooled, he says, adding that Ambrey has tested several CUAS detection systems like MARRS’ in the Red Sea but has not evaluated drone defeat systems. The reason is that given the general line-of-sight ranges at which small UAS operate, Hutchinson sees them as less of a threat to privacy or security in open water and more of an issue while commercial vessels or superyachts are in or near port.

Hutchinson also points out that for less common, larger fixed-wing drones that fly at higher speeds, say those that fly at 90 to 185 mph (150-300 kph), most CUAS systems’ detection ranges (3-6 miles, 5-10km) afford only 15 to 20 seconds notice of a target and its direction, narrowing effective mitigation responses considerably.

“Your response time is extremely small and human error is vast,” he says.

Surface threats, whether piracy or terror, with manned or unmanned vessels, have longer detection timelines, offer better visual cues, and are easier to track thanks to approach speeds generally less than 15 mph (25 kph). Vessels can identify potential surface threats more easily and take evasive action. This could include deploying armed security teams and firing warning shots, if a vessel is hosting them, or otherwise denying a surface vessel a chance to close.

“We’ve seen that with the unmanned surface vessels launched by the Houthis and with pirates,” Hutchinson attests. The implication is that counter-manned/unmanned surface systems are likely more effective for both commercial vessels and superyachts than CUAS systems.

Thus far, Ambrey has yet to see a maritime CUAS system come to market that can guarantee effective drone defeat in all circumstances for superyachts or commercial vessels, Hutchinson adds, suggesting the most effective mitigation still lies in early assessment of risk and changing operational procedures (altering course, turning off AIS, limiting signal emissions) to avoid it.

However, CUAS systems are being sold to private owners in part because of the operational predictability of the superyacht world. In the summer, yachts flock to Monaco, the French Riviera, the Greek and Aegean islands, and other southern European locales stretching East to the Levant. In winter, they migrate to a handful of popular Caribbean anchorages, to Miami, and a few locations to the north of South America.

At each of these, they are generally within sight of land and the line-of-sight range of small drones. They’re static, at the pier or riding at anchor in a harbor, magnifying opportunities for snooping or malfeasance. They can also be located with ease.

“What people always forget about the shipping industry,” Hutchinson observes, “is that we’ve created this culture of readily available public information. You can download an [automatic identification system (AIS)] app on your phone in 30 seconds and track 90,000 ships for free.”

Or you can go online to sites like ShipLocation.com, which has a “superyachts tracker.” The perceived vulnerabilities may be enough to convince a yacht owner to install a CUAS system.

Nevertheless, Rowland says he doesn’t think security firms like Veritas or yacht builders want to “go down the route of selling fear.”

“I think there’s a reluctance to highlight a potential significant threat before that threat materializes.” But he acknowledges that the threat of drones, whether to privacy or yacht security, is rising. “We are on a sliding scale and it isn’t [diminishing], it’s sliding up, getting greater.”

The Vanity Market

Even if owners are concerned about the possibility of prowling UAVs, there’s another obstacle to selling CUAS systems to the superyacht crowd, Rowland affirms. It’s how they look.

“The last thing an owner would like to do is to strap on to their beautifully-designed yacht an ugly piece of equipment to deal with a threat which may or may not materialize. There’s an element of vanity in the [yacht] market.”

Aesthetic concerns are well known to MARSS and other providers who have worked in recent years to both decrease the size, weight and power (SWaP) requirements of CUAS systems and to blend them into superyacht profiles.

“This is of high importance,” Giepmans agrees. “When it comes to placing sensors, it is imperative that they fit in with the overall appearance and design of the yacht. This is done through custom mounting solutions, color schemes and placing sensors within radomes where possible.”

The ball-style radomes seen on any number of superyachts built in the last decade, usually located high atop their superstructures, can sometimes accommodate additional sensors or subtly cloak sensors placed near them. Others (cameras, passive radio antennas) can be discreetly placed on the wings that often adorn masts atop the vessels.

There is another aspect of appearances that may carry weight. Superyacht owners exist within a culture of one-upmanship. If the yacht next to yours at Cap d’Antibes is rumored to have a sophisticated counter-UAS system, you may feel the need to acquire your own to keep pace. And when money is not an object, why wouldn’t you have that feature just like all the others on your massive yacht and, more increasingly often, the toy-packed support vessels that shadow them?

The pressure to provide UAS detection and countermeasures for superyachts may eventually extend beyond the vessels themselves, Hutchinson says. “Where do you put the pressure? Is the onus on the owner/operators or do you put it on the ports, forcing them to change their ISPS codes [International Ship and Port Facility Security Code] to say that ‘we are a secure UAV environment?’”

The odds that superyacht owners and their guests are considered important enough that they might one day enjoy drone-free zones in various ports could change the calculus for acquiring CUAS systems but it remains only a future possibility, not a given.

Similarly, owners face a conundrum when considering adding drone detection to their yachts to ensure privacy or protection – should they buy today or buy tomorrow?

“Do you buy the latest tech or do you wait?” Hutchinson asks. “Where are you operating? What’s your threat and security risk assessment? If you’re concerned, you’re going to be making a high investment into relatively new tech. But in two to three years’ time I think [CUAS acquisition] will be business as usual.”

Rowland takes a slightly different view, averring that decision-making based on privacy and security risks is often made by others with the general approval of superyacht owners.

“It’s a nuanced and complicated part of yacht ownership. For the most part, owners farm these discussions away to other people … within the build process or within the organization that’s overseeing the build.”

Giepmans says that yacht builders are slowly integrating CUAS systems into the construction process of their vessels, consulting with firms like MARSS when owners specify inclusion.

There’s one thing that MARRS’ Giepmans, Veritas’ Rowland, and Ambrey’s Hutchinson all agree on: One publicly acknowledged UAS attack on a yacht would change everything, rapidly propelling the market.

“I think the market for counter-UAV is just starting,” Hutchinson concludes. “Especially in the private market, these kinds of systems will be built-in. There’ll be an expectation that you can have jamming, that you can protect privacy as well as security.”

The transformation that UAS have wrought on the battlefields of Ukraine, Gaza, Lebanon, the Red Sea, and elsewhere is spilling over to many other areas of modern security, creating both risks and fortunes. The direct technology and enabling technologies that have made it a reality have been shepherded by some of the very people who have acquired superyachts in the last few years.

A slowly growing group of them are buying CUAS systems for their vessels. “The irony is inescapable,” Rowland observes.

Contact the editor: Tyler@twz.com