Saudi Arabia is in talks to buy 54 Dassault Rafale multirole fighters, the French company has confirmed. If these negotiations lead to a firm order, that will see Saudi Arabia field a highly impressive multinational fleet of advanced fourth-generation fighters: Rafale, Boeing F-15SA, and Eurofighter Typhoon. It would also represent a serious break for the United Kingdom — represented in the Eurofighter consortium via BAE Systems — from one of its traditional customers.

Speaking to the Association of Defense Journalists, Dassault Aviation’s CEO Eric Trappier confirmed recently that negotiations around a Rafale deal are ongoing with Saudi Arabia, Breaking Defense reported today.

While Saudi Arabia has previously purchased French defense equipment, its fighter aviation needs have long been met primarily by the combined resources of the United Kingdom and the United States.

But it seems that difficulties in securing a follow-on order for Typhoons have provided Dassault with an opportunity to offer its Rafale instead.

Saudi Arabia was long expected to buy more Typhoons, in a deal that would be brokered by BAE Systems of the United Kingdom. However, since Eurofighter is a multinational company, exports have to be approved by the other partners: Germany, Italy, and Spain. Germany — which has a stake in Eurofighter via the German arm of Airbus — has consistently blocked further Typhoon sales to Saudi Arabia, citing concerns over human rights abuses, including the murder of journalist Jamal Khashoggi, as well as Saudi Arabia’s role in the Yemen war.

The same kind of political dispute also appears to have stalled a Turkish effort to buy Typhoons from the same company.

In October, Airbus Chief Executive Guillaume Faury criticized the German government for its harder line on arms exports, including the Saudi Typhoon deal. “The German government’s stance on arms exports to some countries is a real problem,” Faury told the business daily Handelsblatt. “If Germany wants to be a trustworthy partner in major defense projects, it must resolve the issue of export controls with the other Europeans and not in spite of them,” he added.

But the German stance has above all proven to be a thorn in the side of BAE Systems and the U.K. government, which have tried to finalize a lucrative Saudi deal for 48 more Typhoons since 2018.

U.K. Prime Minister Rishi Sunak reportedly discussed the issue with German Chancellor Olaf Scholz in the summer.

By October, there were British fears that the Rafale was emerging as a serious rival in Saudi Arabia’s search for new fighters.

“It’s a competitive bid process,” an unnamed U.K. official told the Financial Times. “We are not complacent about it. The big risk for the UK is if we treat the French offer merely as a stalking horse,” a second unnamed U.K. official told the same newspaper.

Last week, Dassault’s Trappier admitted that “Saudi Arabia has traditionally bought British” aircraft, but that Dassault had been receptive to Riyadh’s approach. He didn’t directly refer to the German-British Typhoon standoff but did note that the request for Rafales was “independent of the crisis in the Middle East.”

At the same time, Trappier said that “periods of conflict are not very favorable and tend to slow discussions a bit.”

Should the Rafale deal between Dassault and Saudi Arabia materialize, it would be a huge loss for Eurofighter but would continue to cement Rafale’s ascendancy on the export market.

The Rafale already has an impressive footprint in the Middle East, with sales made to Egypt, Qatar, and the United Arab Emirates — the latter with an 80-aircraft deal secured in December 2021.

In the last couple of years, Croatia and Greece have also become Rafale customers, while Indonesia announced a contrast for 42 Rafales in February 2022. India, an earlier Rafale export customer, is now lining up a deal for 26 more of the naval Rafale M version to operate from its aircraft carriers.

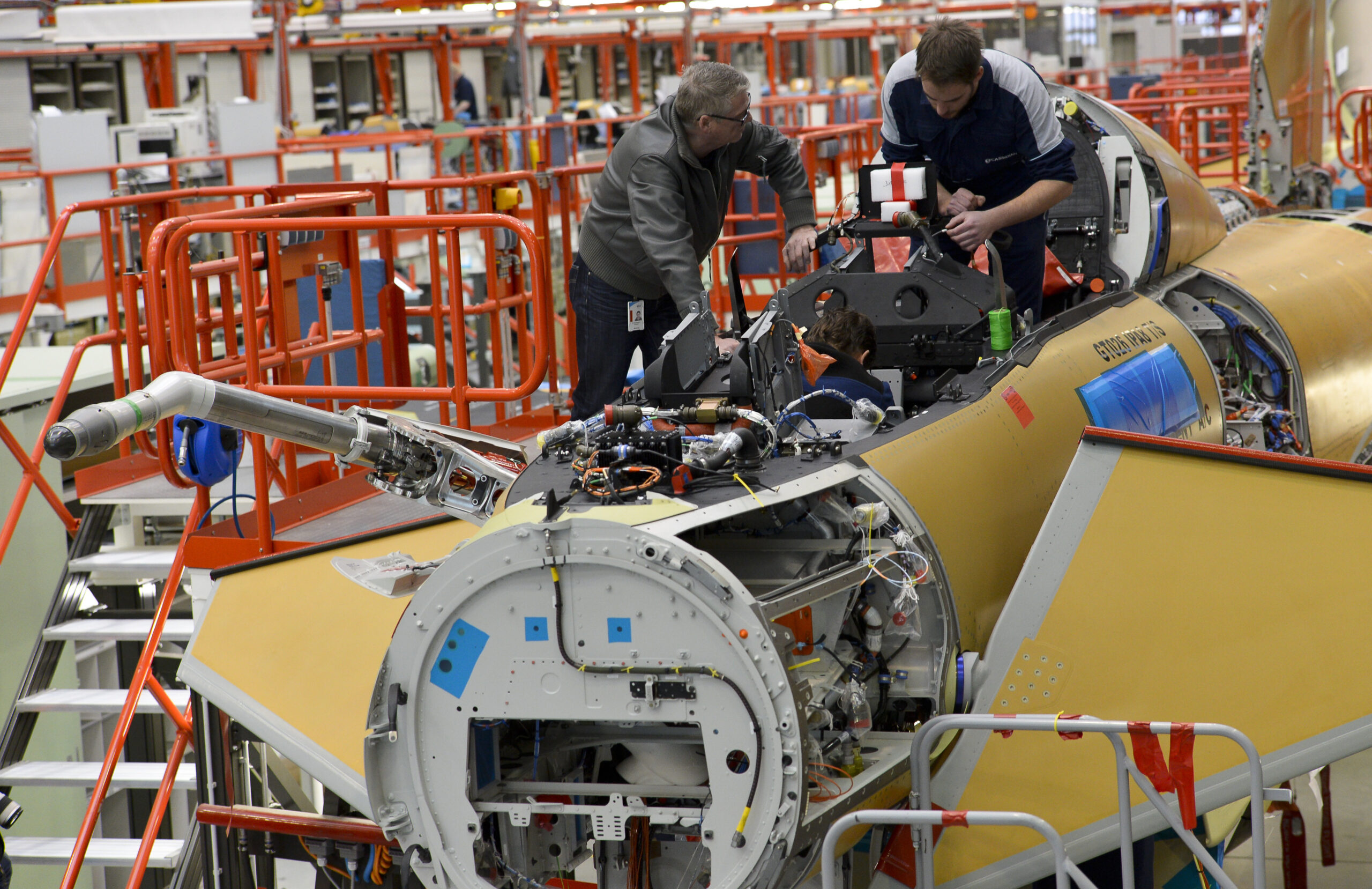

The current production version of the Rafale is the F4, as selected by the United Arab Emirates, some of the capabilities of which we have outlined in the past:

“The F4 standard […] is optimized for networked combat, with new satellite and intra-flight datalinks, as well as a communication server and software-defined radio. The F4 also features upgrades to the radar, electro-optical system, and helmet-mounted display. New weapons are also being integrated, including the forthcoming Mica NG air-to-air missile and the 2,200-pound version of the AASM modular air-to-ground weapon.”

Meanwhile, Dassault is now developing the F5 standard, with plans to field this with the French Air Force in 2030.

The Rafale F5 is seen as a way of bridging the gap between the current Rafale and the sixth-generation Next Generation Fighter (NGF) being developed under the pan-European Future Combat Air System (FCAS) air combat program.

As well as an improved Thales RBE2 XG radar, the F5 will bring a higher level of connectivity, allowing it to better operate alongside uncrewed combat aerial vehicles (UCAVs) of the kind that will be developed as part of FCAS. There is a possibility that the Rafale F5 program could also include “the development of a drone to support the Rafale, based on the Neuron [UCAV] demonstrator.” A companion advanced air combat drone would give any air arm with Rafale and the drone a stealth capability without the need to acquire a stealth fighter and would drastically expand tactical flexibility for the type..

Whether Riyadh ends up with a Rafale F4, F5, or some kind of a hybrid, the addition of these jets to the Royal Saudi Air Force (RSAF) would provide the service with a very capable frontline combat fleet. With the NGF and broader FCAS ‘system of systems’ now also in development, a Saudi Rafale buy could potentially lead the country into orders for some of these capabilities, too.

Already, the RSAF operates an extremely modern and advanced fleet of fighters. It received 84 new-build F-15SAs, the most advanced variant of the Strike Eagle family available until the appearance of the Qatari F-15QA and the U.S. Air Force’s F-15EX Eagle II. Meanwhile, the 68-strong fleet of earlier F-15S aircraft is being upgraded locally to a similar standard, known as F-15SR (for Saudi Retrofit).

As of now, the RSAF has received 72 Eurofighter Typhoons and at one time had even looked at the possibility of local assembly of these aircraft in Saudi Arabia. Older, but still capable are around 80 British-supplied Panavia Tornado IDS swing-wing strike aircraft, which continue in service in the strike role. The Rafales would be an obvious replacement for these jets.

While Saudi Arabia wages a continued campaign against the Iranian-backed Houthi rebels in Yemen, the further modernization and expansion of the RSAF fighter fleet is primarily driven by the threat posed by Iran, its major regional adversary, although tensions between the two powers have subsided as of late. Increasingly, Iran has projected its power across the region, including backing militant groups but also undertaking its own extensive maritime activities in the Persian Gulf and further afield. A flurry of reports suggesting that Iran is poised to acquire advanced Su-35 Flanker multirole fighters from Russia would also reinforce concerns in Riyadh.

It is against this backdrop that Saudi Arabia is seeking to buy new fighters. Whether those aircraft end up being Rafales, Typhoons, or something different altogether will likely rest heavily upon political machinations in Europe in the coming months.

Contact the author: thomas@thedrive.com