The U.S. Air Force’s 2024 Fiscal Year budget request includes plans to divest 310 aircraft, while acquiring just 95 new ones. The service is looking to make substantial new investments in next-generation capabilities and argues that it needs to keep retiring old platforms to free up resources in support of these critical modernization efforts.

The total proposed Fiscal Year 2024 budget for the Department of the Air Force, which includes the U.S. Space Force, is 215.1 billion, excluding so-called “pass-through” funding. Ahead of the formal budget rollout today, the service had also provided additional details at a briefing at the Pentagon last Friday at which The War Zone was in attendance.

The War Zone has already separately highlighted the significant developments with regard to the F-15EX Eagle II program, which you can find here. A brief, but more complete rundown of significant aviation and munition program developments in the proposed budget is as follows.

The complete budget request asks for funding to buy 72 fighter jets in total, as well as other aircraft:

- The Air Force is looking to buy 48 F-35A Joint Strike Fighters in addition to the 24 F-15EX Eagle IIs.

- The service is also looking to buy 15 KC-46A Pegasus aerial refueling tankers, seven MH-139A Grey Wolf utility helicopters, and one E-11A Battlefield Airborne Communications Node (BACN) aircraft.

The Air Force wants to divest a total of 310 aircraft in the 2024 Fiscal Year, including:

- 32 Block 20 F-22A Raptor stealth fighters, all of which are currently tasked with training and other non-combat duties.

- This would reduce the total size of the current F-22 fleet from around 183 to 151.

- The Air Force plans to ultimately replace all of its Raptors with a new sixth-generation stealth combat jet being developed under the Next Generation Air Dominance (NGAD) program.

- The service is currently planning around acquiring 200 of these aircraft, which will cost hundreds of millions each, although this is just a working number at this time and could change.

- 57 F-15C/D Eagle fighters, which would keep the Air Force on course to remove the type entirely from inventory by 2026.

- 42 A-10 Warthog ground attack aircraft, in line with the Air Force’s goal to cut this type completely by the end of the decade.

- Together with the approved divestiture of 21 A-10s in the current fiscal year, the new cuts would bring the total fleet size down to around 218 jets.

- One B-1 bomber, a further reduction of that already shrinking fleet, which is slated for total retirement in the mid-2020s.

- 24 KC-10A Extender aerial refueling tankers, which would complete the planned total divesture of this type.

- 37 HH-60G Pavehawk combat rescue aircraft, pushing ahead with the total divestment of this fleet.

- 48 MQ-9 Reaper drones, the last Block 1 versions currently still in service.

- One RQ-4 Global Hawk drone, which comes as the Air Force has moved to significantly trim back this fleet.

- Two E-3 Sentry Airborne Warning and Control System (AWACS), bringing the total Sentry fleet down to 18 aircraft.

- Three E-8C Joint Surveillance Target Attack Radar System (JSTARS) radar and battlefield management aircraft, the last of these aircraft still in service.

- Two EC-130H Compass Call electronic warfare aircraft, a type that is in line to be replaced with new EC-37B Compass Call planes.

- Four EC-130J psychological warfare aircraft. It’s unclear whether these are the remaining Commando Solo-configured types or so-called EC-130J Super Js that are more readily reconfigurable to take on other tasks.

- Three A-29 Super Tucano light attack aircraft, which had only been acquired in the past three years or so as part of an experimentation effort.

- 52 T-1A Jayhawk jet trainers as part of a plan to phase the type out completely by 2025.

The Air Force is looking to significantly expand procurement of key munitions and help defense contractors expand their production capacity for those weapons, to include:

- $1 billion to initiate multi-year procurement of additional AGM-158 Joint Air-to-Surface Standoff Missile-Extended Range (JASSM-ER) cruise missiles, AGM-158C Long Range Anti-Ship Missiles (LRASM), and AIM-120 Advanced Medium Range Air-to-Air Missiles (AMRAAM).

- The planned purchase of 550 JASSM-ERs represents the current maximum per-year production capacity for those missiles.

- The proposed funding in this budget would help lay the groundwork to get that up to 810 missiles per year.

- The 487 AMRAAMs request is 186 more than the service asked to buy last year, and is in part driven by a need to replenish stocks of older types transferred to Ukraine.

- $161 million for 48 Joint Strike Missiles (JSM), a new start acquisition effort.

- JSM, developed jointly by U.S. defense contractor Raytheon and Norwegian firm Kongsberg Defense, is a derivative of the increasingly popular Naval Strike Missile (NSM) that is now in service with the U.S. Navy and Marine Corps.

- Though the U.S. military has been involved in the development of the air-launched JSM cruise missile for years now, it has not moved to purchase any for its own use until now.

The Air Force is requesting billions in research and development and test and evaluation funding to support work on a host of next-generation aircraft and to help recapitalize key capabilities:

- $3 billion to support continued Engineering and Manufacturing Development (EMD) work on the B-21 Raider stealth bomber and $2.3 billion to support actual procurement of these aircraft.

- The B-21, six of which are in various states of construction now, is expected to take its first flight this year.

- $276 million for NGAD, primarily for supporting additional risk reduction work on the crewed combat jet component.

- The Air Force says this brings funding for the NGAD program to date to around $1.9 billion, but it’s possible, if not probable that other funding streams flow into this broad effort, including from classified portions of the budget.

- $470 million specifically for the Collaborative Combat Aircraft (CCA) advanced drone program, which is part of the NGAD initiative.

- This funding would support three main lines of effort: the development of the CCA platform itself, autonomous capabilities development, and the establishment of an actual experimental operations unit to help refine how the service expects to employ these uncrewed aircraft.

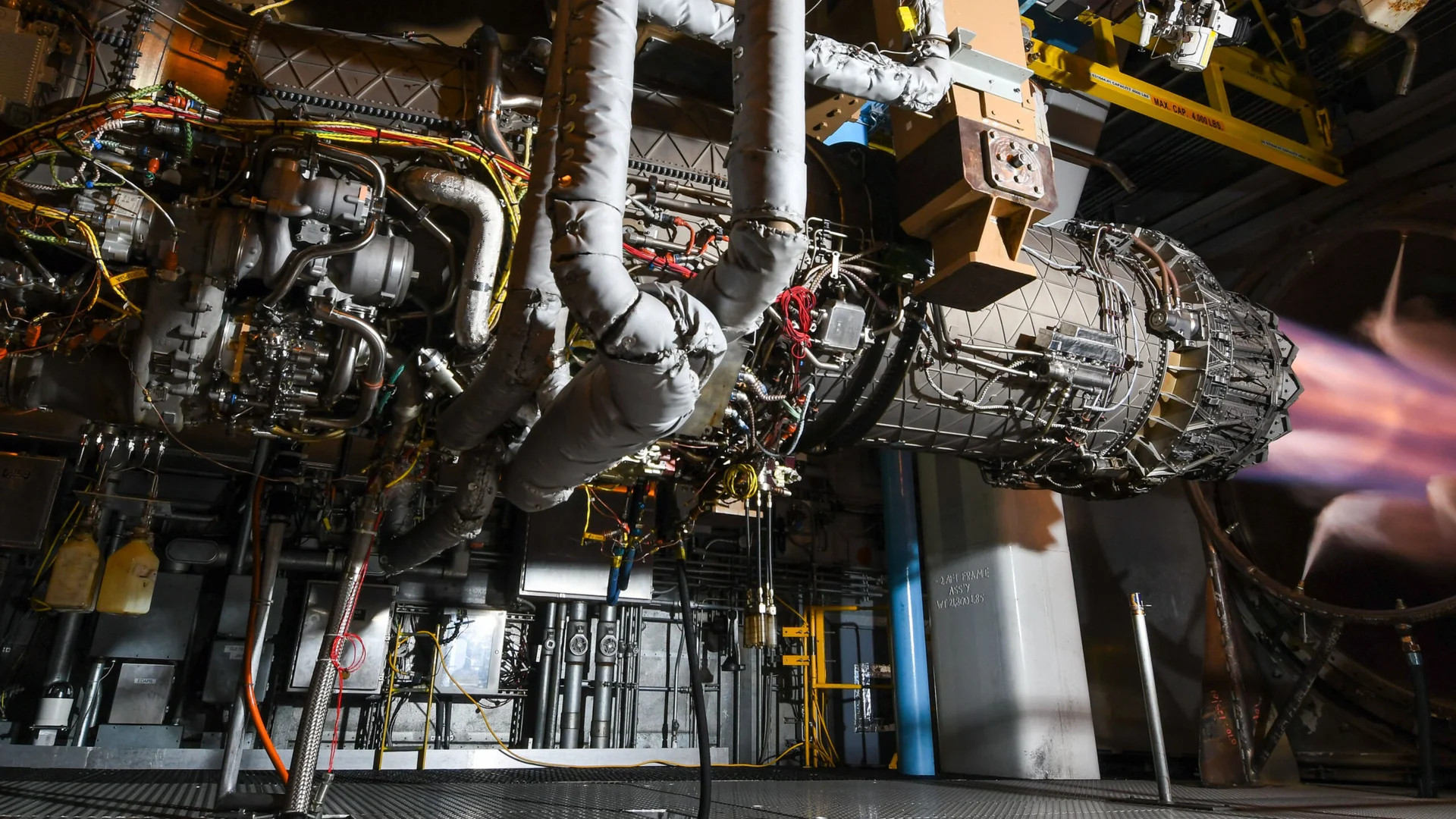

- $35 million to support the Next Generation Adaptive Propulsion (NGAP) advanced aircraft engine program, another element of NGAD.

- The Air Force also disclosed that the decision has been made not to re-engine F-35 Joint Strike Fighters, including those in the U.S. Navy and U.S. Marine Corps, in favor of a less intensive engine core upgrade effort.

- $8 million for the Next-Generation Aerial Refueling (NGAS) future tanker effort, which will help the Air Force finalize its plans for this program.

- $200 million to support the B-52 Commercial Engine Replacement Program (CERP) effort, bringing the total spending on that program to $900 million.

- $3.7 billion for the LGM-35A Sentinel intercontinental ballistic missile (ICBM) program, which will help fund the development of missile flight systems and other components, as well as major infrastructure work to upgrade existing silos and launch facilities to support the new weapons.

- $911 million to continue development of the nuclear-armed Long-Range Stand-Off (LRSO) cruise missile.

- $150 million to support ongoing developmental work on the AGM-183A Air-launched Rapid Response Weapon (ARRW), including completing the remaining four currently planned flight tests.

- $384 million for the Hypersonic Attack Cruise Missile (HACM) program, which is expected to leverage work already done through Defense Advanced Research Projects Agency’s (DARPA) Hypersonic Airbreathing Weapon Concept (HAWC) project.

- $264 million for continued work on advanced networking and other related capabilities being developed under the Advanced Battle Management System (ABMS) program.

- Proposed ABMS funding in Fiscal Year 2024 would support continued work to give KC-46 tankers capabilities to act as airborne communications nodes, improvements to digital infrastructure, and new command and control capabilities.

- $791 million for the Survivable Airborne Operations Center (SAOC) program, which is seeking a replacement for the Air Force’s E-4B Nightwatch ‘doomsday’ planes, to support ongoing development efforts as the Air Force moves toward finalizing an acquisition strategy.

- The Air Force declined to offer specific details, but said that SAOC funding would allow for the acquisition of unspecified “test articles.”

- $254 million to support the development and acquisition of a U.S.-specific version E-7 Wedgetail radar plane as a replacement for the service’s E-3 Sentry AWACS aircraft.

- This funding would primarily go toward purchasing a second E-7 prototype.

When it comes to divestitures, the Air Force has stressed that none of its proposed cuts this year are entirely new. With the exception of the F-22 and E-3 cuts, these all follow planned retirement schedules. The service tried to trim back the Raptor fleet and speed up the divestment of E-3s in its 2023 Fiscal Year budget request, but failed to secure Congressional approval.

Overall, the Air Force’s 2024 Fiscal Year budget request very much reinforces the view of the service’s current leadership that it needs to be able to steadily replace older legacy platforms with next-generation capabilities to be able to succeed in future high-end conflicts, such as a potential one in the Pacific with China. The multi-faceted NGAD initiative, including the CCA and NGAS efforts, along with the B-21 program, among other things, is central to this vision.

At the briefing at the Pentagon last Friday ahead of today’s budget rollout, Secretary of the Air Force Frank Kendall was specifically asked about the E-3 cuts given that the replacement E-7s, and potentially other capabilities, are still years away from entering service. Kendall defended the current plan by pointing out that the Sentry’s fleet readiness levels, together with the type’s increasing obsolescence, limit what capabilities it offers already. He added that the hope was that being able to focus resources on a smaller fleet of E-3s would help improve their readiness. Cannibalizing retired airframes to keep in-service ones flying more reliably is likely a key part of this move, as it has been in the past with other aircraft, like the B-1.

Kendall also provided additional justification for the Air Force’s previous decision to truncate purchases of HH-60W Jolly Green II rescue helicopters to replace the HH-60Gs that are being retired. He said that there was nothing else new in the service’s Fiscal Year 2024 budget proposal regarding other concepts for combat search and rescue (CSAR).

“There are a lot of other assets around that, if somebody goes down at sea for example, we could use to pick them up,” he explained. “We’re going to do it [the CSAR mission] with existing assets, either our own or provided by other military departments.”

Though treated like something of an aside at that same briefing, Kendall’s announcement that the re-engine initiative for the U.S. military’s F-35 fleet has come to an end, at least for the time being, is also a very important new development.

A “combination of affordability and the fact that the Air Force, with the A variant, was the only service that was really seriously interested” in the re-engining idea heavily contributed to that decision, Kendall said last Friday. “There was some discussion about whether it [the new engine] would go in the C variant… [putting it in] the Marine Corps [B] variant was going to be very, very difficult, if not impossible.”

These are issues The War Zone highlighted in the past when discussing the possible re-engining effort. All three F-35 variants are substantially different from each other, but the short-takeoff and vertical landing-capable B model is especially distinct.

“Trying to find a solution that would provide acceptable levels are increased performance for all three services was kind of where we ended up – that plus the unit cost,” he continued, referring to the current plan for a less extensive engine core upgrade. “If the cost had been lower, we might’ve been able to work it into the Air Force’s budget alone, but at the level of several billion dollars to do that EMD, we couldn’t get there.”

Kendall noted that work already done on possible new engines for the F-35 through the Adaptive Engine Transition Program (AETP) will feed into the NGAP engine effort.

The Air Force, as well as the Navy and Marines, are still expecting to see the capabilities of the F-35s substantially expand in the future through the broader Block IV upgrade effort. In addition, while the new Joint Strike Missiles that the Air Force is now looking to buy could potentially be launched from various aircraft, they were developed around a core requirement to be carried internally on the F-35A and C.

The Air Force’s exact plans for its JSM arsenal are not entirely clear, with reports indicating that they may be intended solely as a “bridge” to further acquisitions of LRASMs. These cruise missiles would give the service’s A variants a valuable new stand-off land attack and anti-ship capability, as you can read more about here.

As always, it is important to remember that Congress has the final say on the U.S. military’s budget for the 2024 Fiscal Year, as a whole. Legislators can and do often block cuts – as they did just last year with regard to the F-22 fleet – and also regularly add money to various programs beyond what the Air Force and the other services request. Considering existing airframes are being retired at a three-to-one ratio with those that are being procured, there are bound to be major concerns. The USAF’s apparent strategy of significantly cutting airpower capacity now and ‘accepting some risk’ in hopes of acquiring far more advanced systems sometime in the future has become a lightning rod of contention on Capital Hill already.

As we do every year, The War Zone will be taking closer looks at the more detailed budget documents from the Air Force, as well as those from elsewhere around the Pentagon as they are released. More granular details about aviation and other programs almost always emerge from the full annual budget proposal.

Contact the author: joe@thedrive.com