In something of a surprise development, a new French-made drone, the Aarok, has emerged in prototype form ahead of the Paris Air Show trade exhibition next week. The Aarok uncrewed aircraft system, or UAS, is a new addition to the medium-altitude, long-endurance (MALE) segment and is intended to fly intelligence, surveillance, and reconnaissance (ISR), as well as strike missions. For the latter, it is planned to carry the French-made AASM Hammer, a precision-guided weapon with an extended standoff capacity and different warhead sizes.

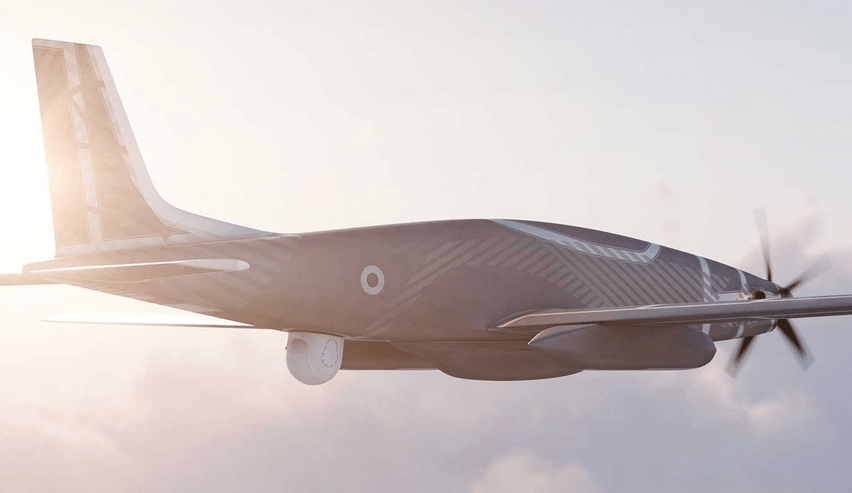

The Aarok is a product of a previously little-known French defense contractor, Turgis & Gaillard, which has steadily expanded its operations in its home country, culminating in the impressive Aarok prototype. Weighing in at around 5.4 tons, in maximum takeoff configuration, the drone has attracted attention on account of its size. Its 72-foot wingspan is actually only marginally larger than the U.S.-made MQ-9A Reaper, with its wingspan of a little over 69 feet, but the fuselage is considerably more bulky in comparison.

Power for the Aarok comes from a 1,200-horsepower Pratt & Whitney Canada PT6 turboprop driving a conventional front-mounted propeller. In the future, Turgis & Gaillard plan to install a Safran Ardiden 3 or GE Aviation Catalyst turboprop.

As well as the 5.4-ton maximum takeoff weight, published specifications of the Aarok include an empty weight of around 2.5 tons and a maximum payload of 6,000 pounds, including up to 3,300 pounds of weapons.

The drone is planned to have an endurance of more than 24 hours. These parameters put the Aarok in a broadly similar category to the MQ-9A Reaper, which is already in service with the French Air Force.

The Aarok’s design is intended to allow operations from rough fields, with notably robust landing gear being one of the key features of the prototype.

Turgis & Gaillard says it’s been developing the Aarok for three years. The company’s director general, Patrick Gaillard, told The War Zone that the drone is intended to undertake “ISR missions, standoff strike missions, maritime surveillance, and also multi-domain communication relay.” In the last of these roles, the Aarok would be used as “a kind of French BACN,” Gaillard said, in reference to the U.S. Air Force’s Battlefield Airborne Communications Node.

The BACN payload allows aerial platforms to act as highly specialized aerial communications nodes that can rapidly shift information to and from a wide variety of airborne platforms to other airborne platforms and forces on the ground and sea. This communications gateway system has been mounted on both crewed E-11A aircraft – modified Bombardier Global Express-series business jets – and now-retired EQ-4B Global Hawk drones.

The Turgis & Gaillard website says that the ISR package for the Aarok would include “high-performance optronic and electromagnetic sensors,” with IHS Janes suggesting the Wescam MX-25 or Euroflir 610 as the most likely sensor options. The size of the drone, with plenty of space under the wings and fuselage to hang different types of payloads, as well as a capacious fuselage, means that it will be able to simultaneously carry “a large electro-optical sensor (camera), a multimode radar, and signals intelligence payloads,” the manufacturer says.

Meanwhile, weapons for strike missions would include the AASM Hammer, which is available with a range of guidance options, inertial and GPS, laser, and infrared. Warheads can be of different sizes, too, with options to mate the AASM with 276-pound, 550-pound, 1,100-pound, and 2,200-pound bomb bodies.

“With the Hammer, we have a range of 35 kilometers [22 miles], so we’re not too worried about the Pantsir,” Gaillard added, referring to the Russian-made short-range air defense system. It is tempting to wonder if the reference to Pantsir might be something of a swipe at the U.S Air Force MQ-9 that was fired on by a Russian Pantsir-S1 air defense system over eastern Syria, last November. While it did not succeed in shooting the drone down, the incident does go to show the increasing range of threats faced by drones that don’t necessarily have standoff capabilities.

Interestingly, the company press release mentions the Aarok carrying out “high-intensity strikes even in contested areas,” suggesting that its equipment will also include some form of self-defense suite, whether using countermeasures such as chaff and flares, a jammer, or some kind of Directional infrared countermeasures (DIRCM), or most likely a mix of these systems.

Turgis & Gaillard, which was set up in 2011, began life as a design office tasked with developing the Gerfaut, a system for integrating French precision-guided munitions, namely the Hammer, under the wing of C-130 Hercules transport aircraft. The aim was to provide low-cost close air support and interdiction for counterinsurgency operations like those in Afghanistan and Mali. Gerfaut does not appear to have led to a production contract, but the experience gained during the integration process would surely help with weaponizing the Aarok. It is also worth noting that the U.S. Marine Corps Harvest HAWK offers a similar concept to the Gerfaut, and has seen extensive operational use.

In fact, Turgis & Gaillard has swiftly managed to establish itself on the French defense scene by pursuing a broad range of innovative projects, primarily in the aerospace realm. These include producing equipment for Dassault Rafale fighter jets, maintaining DHC-6 and PC-6 special operations aircraft for the French Armed Forces, and even making some ground equipment for the F-35, which is not used by France.

The Aarok is clearly the company’s most ambitious program to date and its development has been self-funded so far. Turgis & Gaillard is targeting the new drone at both domestic and export customers, promising “a reduced cost, both in purchase and use,” according to Fanny Turgis, the company’s president. In a press release, the company suggests that one mission for the drone would be “maritime surveillance missions in large Exclusive Economic Zones, especially in the Indo-Pacific.” The statement also reflects the growing importance of the Indo-Pacific area more broadly and could also be tied to France stepping up its efforts to be increasingly engaged in this region.

Otherwise, however, there has been no mention of specific target markets or export customer interest. However, according to at least one report in the French media, when it goes on display at the Paris Air Show next week, the Aarok will be displayed “a few meters from [the stand] of the Ministry of the Armed Forces,” suggesting that the objective is to convince French military decision-makers to choose the new product.

Traditionally, France has had some notable success in arms sales to nations in Africa and the Middle East. With a big demand for overland and overwater surveillance capacity in both those regions, the Aarok could attract interest. Furthermore, with an aggressive export policy, France may well seek to pitch the Aarok to customers otherwise not able to buy Reapers or other U.S.-made armed drones.

In terms of competition, the Aarok provided it reaches production, enters a fairly crowded marketplace. While the domestic scene might offer the best opportunities, France is already flying the broadly similar MQ-9A Reaper.

France acquired six Reaper Block 1 and six Reaper Block 5 drones, before ordering a further six Block 5 vehicles. The Block 5s can be armed with GBU-12 Paveway precision-guided bombs and AGM-114 Hellfire air-to-surface missiles.

The French Reapers were acquired to meet an urgent operational requirement for ISR, especially as part of the French operation in Mali, including long-endurance flights over the north of the country to track down militants.

Longer term, Turgis & Gaillard may well be hoping to provide France with a homegrown successor to the Reaper, providing a drone that could also complement the forthcoming Eurodrone.

The Eurodrone is a twin-turboprop MALE drone, somewhat larger than the Aarok, with a maximum takeoff weight of around 24,000 pounds, a payload of over 5,000 pounds, and a wingspan of a little over 98 feet.

Under the European Medium-Altitude Long-Endurance Remotely Piloted Aircraft System (MALE RPAS) effort, the Eurodrone is being developed by Airbus, Dassault Aviation, and Leonardo and is planned for service with France, Germany, Italy, and Spain. Its first flight is expected by mid-2027 but service entry is not expected until 2030, at the earliest.

As well as the Reaper, the Aarok would also face competition from Turkey’s Baykar Bayraktar Akinci, another twin-turboprop MALE drone. With an endurance of 25 hours, a payload of around 3,000 pounds, and a wingspan of just under 66 feet, the Akinci is in many ways a fairly close match to the Aarok. The Baykar drone is already in service with the Turkish Armed Forces, Pakistan, and Libya, with further orders placed by Azerbaijan and Kyrgyzstan.

As far as timelines are concerned, Gaillard has said that the company aims for a first flight before the end of this year. That could lead to service entry from mid-2025, depending on securing the required authorizations from the DGA, the French defense procurement and technology agency.

The war in Ukraine has shown that drones are here to stay, even in contested environments. Meanwhile, armed drones, especially, are a niche that many Western countries, including France, have been slow to develop. As a result, the French military now relies on the U.S.-made Reaper for drone strikes. That gap has meant that countries like Turkey and China have been able to dominate sales of armed drones, especially with the export of U.S. products in this sector being strictly governed.

If Turgis & Gaillard is able to bring an already weaponized MALE drone to market as quickly as it says it can, it could draw the interest not only of the French Armed Forces but also export customers. And if the Aarok also comes with a price tag that is genuinely significantly lower than rival drones, it could well do better still, with a lower-cost, mass-produced armed drone — that operators would be more willing to sacrifice on a high-threat battlefield — potentially being a very attractive proposition indeed.

Contact the author: thomas@thedrive.com