A U.S. military program to explore new low-cost air vehicles that could be turned into cruise missiles, as well as electronic attackers and more, is just as much about upending the status quo when it comes to producing air-launched munitions. Expanding the available industrial base could be critical for helping stock up on more affordable weapons ahead of a future high-end conflict, such as one against China, and sustaining those inventories in a protracted fight. Leveraging supply chains outside of the United States, including as sources for complete munitions, might be another essential part of this equation.

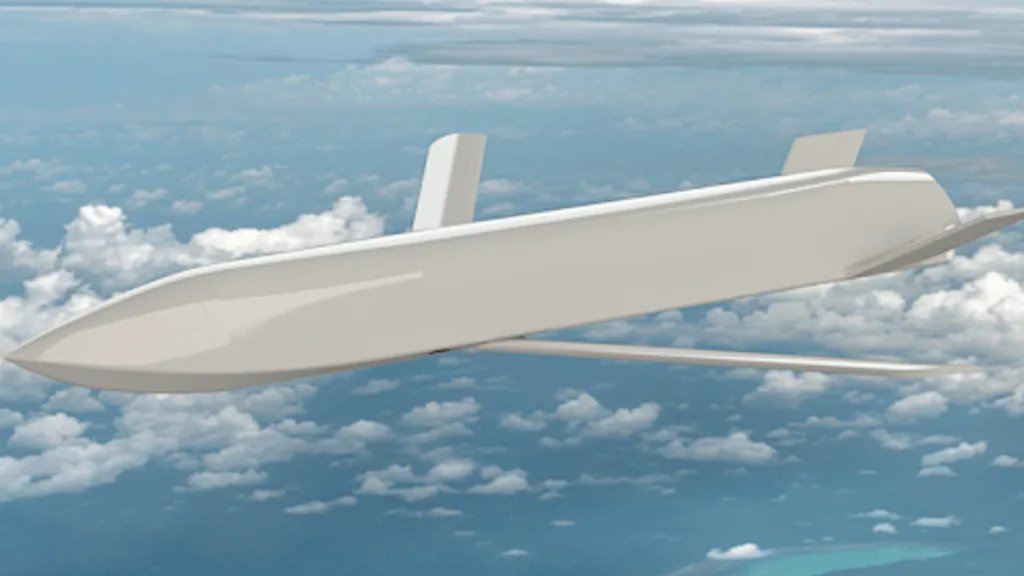

Vice Chief of Staff of the U.S. Air Force Gen. James Slife discussed what is formally called the Enterprise Test Vehicle (ETV) program, as well as other supply chain issues, during a virtual talk that the Air & Space Forces Association’s Mitchell Institute for Aerospace Studies hosted earlier today. The Defense Innovation Unit (DIU) is leading the ETV effort in cooperation with the Air Force Life Cycle Management Center’s Armament Directorate.

“I think [an]… area worth looking at is we recently announced a program in conjunction with the Defense Innovation Unit for the Enterprise Test Vehicle, which is kind of an interesting name,” Slife said. “Really, it’s all about how can you produce long-range capabilities to deliver a variety of effects… using low-cost modular payloads and vehicles.”

The Air Force has said in the past that it is interested in the ETV effort, particularly as a stepping stone to a new lower-cost cruise missile. Slife highlighted how the ‘vehicles’ might also be configured to produce “an electronic support effect” or conduct “electronic attack” missions, as well as for use as “a kinetic munition.”

The U.S. Air Force has a now-long-standing interest in lower-cost stand-off munitions. Expecting to be tasked with prosecuting tens of thousands of targets in the opening stages of a high-end conflict, especially one in the Pacific against China, the service sees a critical need to economically bolster its stockpiles now and ensure it can keep weapons flowing. Other branches of the U.S. military are faced with similar realities and are pursuing similar efforts in part to make sure their arsenals can keep up with the demands of a high-end fight.

“These things may not be quite as exquisite, but we can produce them in high volumes at relatively low cost,” Gen. Slife said. “So, that mixture of high volume low-cost munitions, coupled with some of our more exquisite munitions being mixed in provide a very difficult problem for our adversaries to defend against.”

In turn, there is growing broader interest across the U.S. military in finding new ways to increase production capacity for munitions, as well as other critical systems, and do so affordably, to meet operational demands. Demonstrating new technologies and techniques to help scale up production is already known to be a core element of the ETV program. Speaking today, Gen. Slife highlighted how the effort is also exploring avenues to do more than just build things faster.

ETV presents a path “to expand our industrial base into non-traditional suppliers that perhaps have not historically been large-scale munitions producers,” the Air Force’s number two officer continued. “If the manufacturing techniques we’re able to leverage pan out we’ll be able to take advantage of a bigger part of the American industrial base to produce munitions for us.”

This was reflected in DIU’s announcement in June that Anduril Industries, Integrated Solutions for Systems, Inc., Leidos subsidiary Dynetics, and Zone 5 Technologies had been selected to design, build, and flight test their ETV concepts. None of these companies are among the large prime contractors typically associated with munitions production in the United States today, though they are involved to varying degrees in this arena.

Anduril has been steadily acquiring other companies and otherwise expanding its portfolio, which now includes multiple kinds of loitering munitions and a novel surface-to-air interceptor, among many other things, since its founding in 2017. Zone 5 has been involved in the Air Force’s separate Cargo Launch Expendable Air Vehicles with Extended Range (CLEAVER) project, another powered air-launched munition effort. The ETV concept from Dynetics, now a subsidiary of Leidos, looks very much like a powered derivative of its GBU-69/B precision-guided glide bomb, which is in service now with the U.S. Special Operations community. Integrated Solutions for Systems has a history of providing engineering, rapid prototyping, and other support to missile and other munition programs.

Interest in expanding industrial capacity, in addition to accelerating development and production cycles, is a trend that has already been emerging across the U.S. military. Just when it comes to the U.S. Air Force, a desire to enlarge available supplier bases has also emerged in discussions about future drones, especially those under development as part of the Collaborative Combat Aircraft (CCA) program, and next-generation jet engines. Anduril’s Fury, which you can read more about in detail in this War Zone feature, is one of two designs being worked on now as part of the first increment of the CCA effort.

AsThe War Zone has highlighted in the past, expanding industrial base options could help drive down costs due to increased competition, but could also lead to new collaborative opportunities. A company that ‘loses’ out on a particular contract might still be brought in as a subcontractor, especially if the core underlying design is intended to be highly modular and make use of open-architecture subsystems. This, in turn, could help further spread out cost and risk burdens, while also accelerating development and production timelines.

In his comments today, Gen. Slife also pointed to how foreign suppliers serve as another means to help bolster U.S. military munition supply chains, including as additional sources for complete weapons.

“I think we can take advantage of some of our allies and partners who have hot munitions production lines of munitions that are highly capable and can be easily integrated into U.S. Air Force platforms,” he said. “I think when you look at… supply chains and industrial base [issues], I think, you know, again, our allies and partners are a critical advantage for us and so we ought to be taking advantage of that.”

It’s worth noting here that the Air Force just put in its first order for Joint Strike Missiles (JSM) to arm its F-35A Joint Strike Fighters earlier this year. Norway’s Kongsberg Defense and Raytheon in the United States jointly developed the JSM, an air-launched cruise missile derived from the former company’s Naval Strike Missile (NSM).

JSM, which can engage ships at sea and targets on land, is ostensibly intended as a ‘bridge’ to future plans to add the AGM-158C Long Range Anti-Ship Missile (LRASM) to the Joint Strike Fighter’s arsenal. However, the JSM and the AGM-158C are really different categories of weapons that both offer valuable additional capabilities for the Air Force and other F-35 operators. The JSM notably can be carried internally on F-35A and C variants, unlike the AGM-158C (and other variants of the larger AGM-158 family), allowing the jets to employ the weapons while operating in their most steady modes.

NSM, primarily designed as an anti-ship cruise missile, but that has secondary land-attack capability, is another example outside of the air-launched realm of how the U.S. military is already leveraging foreign-designed munitions pipelines. The U.S. Navy is in the process of integrating NSM onto all of its Independence and Freedom class Littoral Combat Ships (LCS) and the U.S. Marine Corps is also fielding the missile in a ground-based configuration using a remotely-operated launch vehicle based on the 4×4 Joint Light Tactical Vehicle.

As part of the ongoing 2024 Rim of the Pacific (RIMPAC) exercise in the Pacific off Hawaii earlier this month, the Navy also fired an NSM from an Arleigh Burke class destroyer, the USS Fitzgerald, for the first time. The service has told The War Zone that the results of that event will help inform a decision about whether or not to add the missiles to more ships of this class.

Raytheon has been working to expand production of NSM in the United States to meet this growing demand, too.

The U.S. and Japanese governments also touted “high-priority efforts to pursue mutually beneficial co-production opportunities to expand production capacity of [AIM-120] Advanced Medium-Range Air-to-Air Missiles (AMRAAMs) and Patriot PAC-3 Missile Segment Enhancement (MSE), in order to meet critical demands for such advanced systems, address timely procurement and readiness requirements, and deter aggression,” just this weekend after a meeting between the two countries top defense and diplomatic officials.

There are already many other existing examples of partnerships between defense contractors in the United States and other countries around the world that could be built upon. A number of relationships are in the Pacific region beyond just Japan. This includes engagement with firms in Australia and South Korea, as well as subsidiaries of U.S. companies in those countries. Expanded defense industrial cooperation is also a key component of the trilateral Australia-United Kingdom-United States (AUKUS) security agreement.

Broader concerns about munitions expenditure rates and the capacity of the U.S. industrial base to replenish those stocks have already emerged as a result of the ongoing crisis in and around the Red Sea since October 2023. Lessons being drawn from the U.S. military’s response to Iran’s retaliatory strikes on Israel in April, as well as observations from the war in Ukraine, are only adding to these worrying data sets. The Air Force just recently disclosed that its Extended Range Attack Munition (ERAM) effort to produce a relatively low-cost precision-guided air-launched munition with a range of up to 250 miles, is primarily intended to help get the Ukrainian armed forces a new affordable source of stand-off weapons.

As a prime example, the Navy just recently revealed that the ships and aircraft assigned to the supercarrier USS Dwight D. Eisenhower‘s strike group employed 770 air-to-air and air-to-ground munitions, including 135 Tomahawk cruise missiles, during a historic deployment to the Red Sea. The expeditionary rates for stand-off weapons like Tomahawk in an all-out conflict with China would be even greater. At the same time, in its proposed budget for the 2025 fiscal year, the service laid out plans to order a total of 181 new-production Tomahawks over the next five years. That particular supply chain also now has additional demands from the Marine Corps and the Army, as well as foreign customers.

Altogether, working to diversify and expand available munitions industrial capacity and associated supply chains through programs like ETV looks set to be not just valuable, but critical to ensuring the Air Force and the rest of the U.S. military has the stockpiles it needs to fight and win, especially in a future high-end conflict.

Contact the author: joe@twz.com