Ares Industries, a new U.S. defense start-up, says it began flight testing of a compact and relatively low-cost anti-ship cruise missile concept within 11 weeks of its founding. This comes amid a new surge in interest in cheaper stand-off munitions within the U.S. military as it shifts its focus to preparing for conflicts with high-end fights, especially one against China in the Pacific, that could require massive expenditure of munitions. A growing consensus is also emerging within America’s armed forces that large established prime contractors will not be able to meet these demands alone and that more attention should be given to what smaller firms have to offer.

Ares announced its flight test and otherwise laid out its company vision in a press release yesterday. The news came via the powerful technology incubator Y Combinator, which is backing the start-up in its first-ever foray into the weapons sector. Founded in 2005, Y Combinator has become a Silicon Valley institution, having raised hundreds of billions of dollars over the years to help launch thousands of companies, including Airbnb, DoorDash, and Reddit.

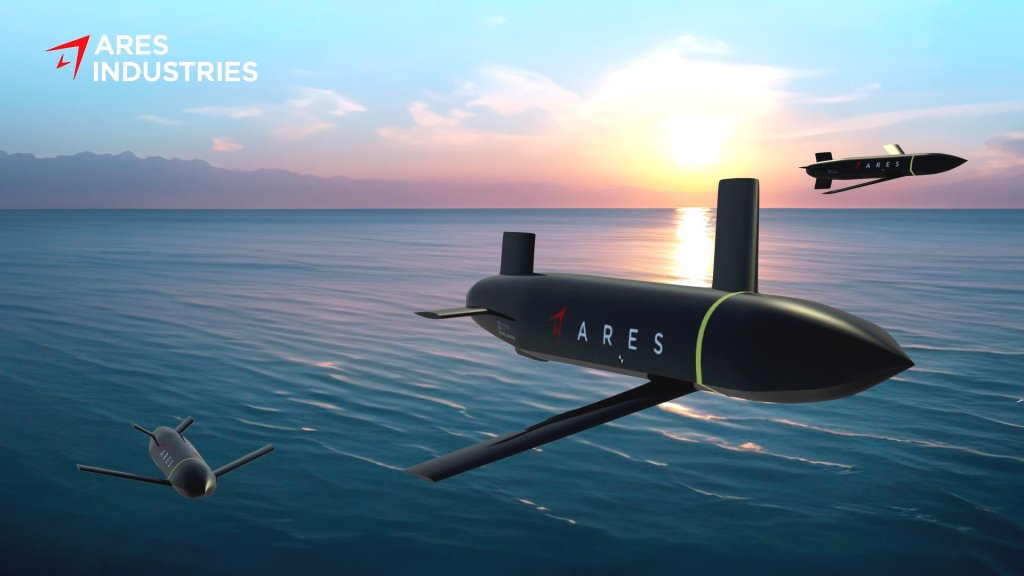

“Ares is building a new class of anti-ship cruise missiles. We are going to deliver the capabilities that the DoD wants in a form factor that’s 10x smaller and 10x cheaper,” according to the release. “Our missiles will be compatible with existing launch platforms, deliver smaller payloads at high subsonic speeds, and take out ships hundreds of miles away. We’re focusing on ground and ship-launched variants to start but will expand into air-launched versions, as well as versions with extended ranges and different payloads.”

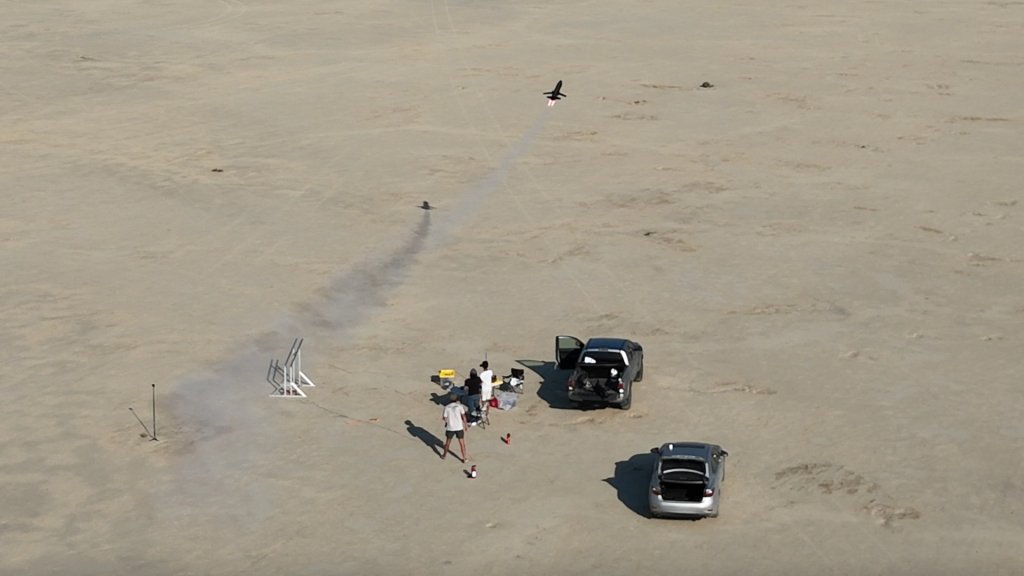

“We spent the summer building multiple prototypes and flight-testing them in the Mojave,” the release adds. “In 11 weeks, we went from starting the company to flight testing with our own design.”

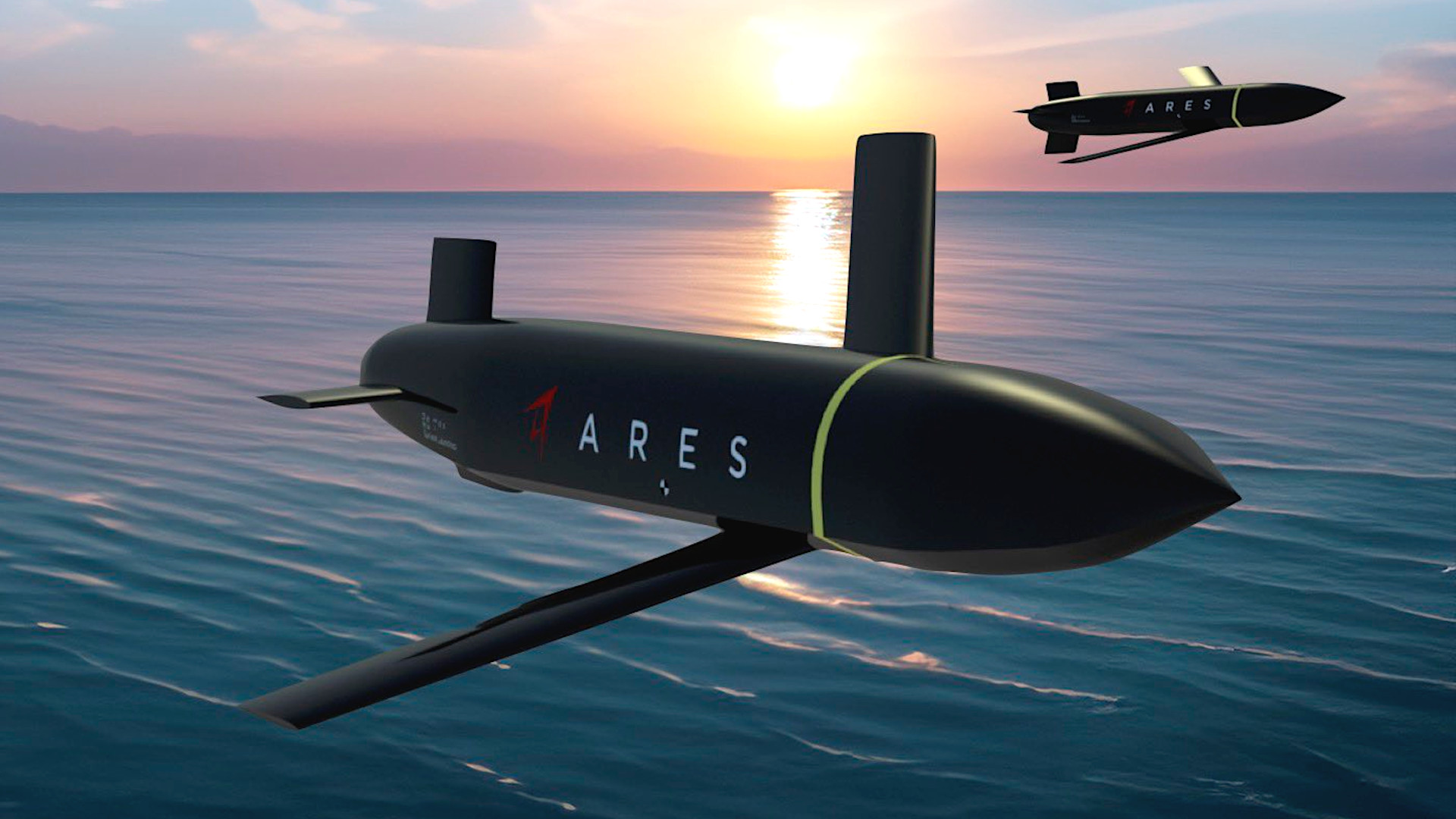

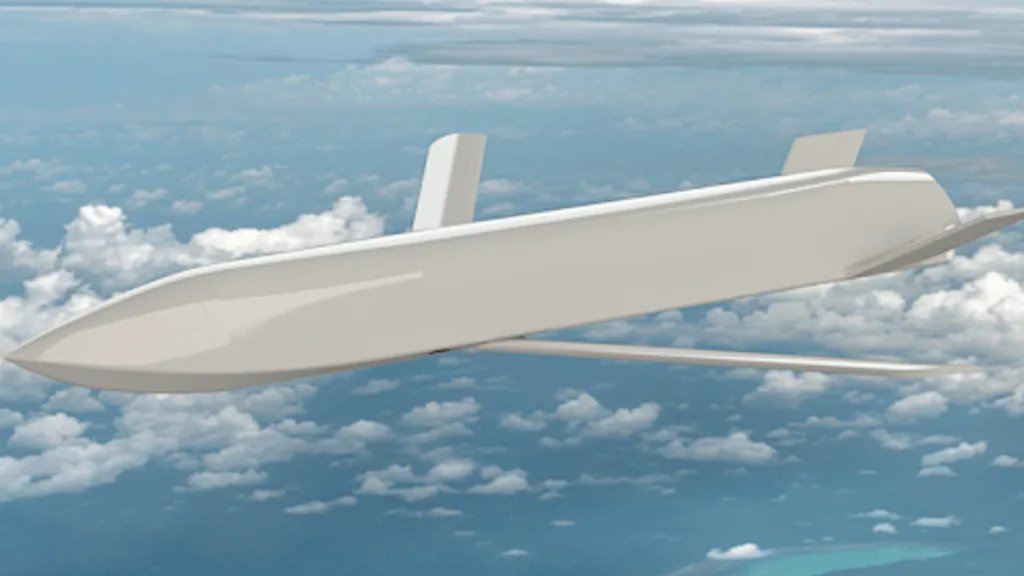

Details about that flight test and how much the design in question reflects the expected final product are unclear. A rendering the company has put out, seen at the top of this story and below, shows a stealthy-looking munition with a notable chine line that wraps around the front end, as well as pop-out main wings and tail fins. The design’s overall form has some very broad similarities to existing cruise missiles and other similar “air vehicles,” including Lockheed Martin’s air-launched Speed Racer drone.

Ares does not yet appear to have released any hard specifications, current or planned, but says that it is targeting a $300,000 unit cost for its missiles. The company has also drawn a comparison between this goal and current anti-ship cruise missiles that cost around $3 million apiece, which appears to be a reference to Lockheed Martin’s AGM-158C Long Range Anti-Ship Missile (LRASM).

The AGM-158C is currently only in U.S. service in an air-launched configuration, but has also been successfully test-fired from a warship using the Mk 41 Vertical Launch System (VLS). The U.S. military’s current anti-ship cruise missile inventory also includes Tomahawks (including forthcoming types further optimized for the ship-killing role), Naval Strike Missiles, and Harpoons, but these also all cost between $1 million and $2 million each. The video below from The War Zone‘s YouTube channel explores these and other naval missile costs in more detail.

Ares’ release also says it is “on track to deliver early working missile systems to our first customers by mid-2025,” but does not elaborate.

The War Zone has reached out for more information about Ares’ work.

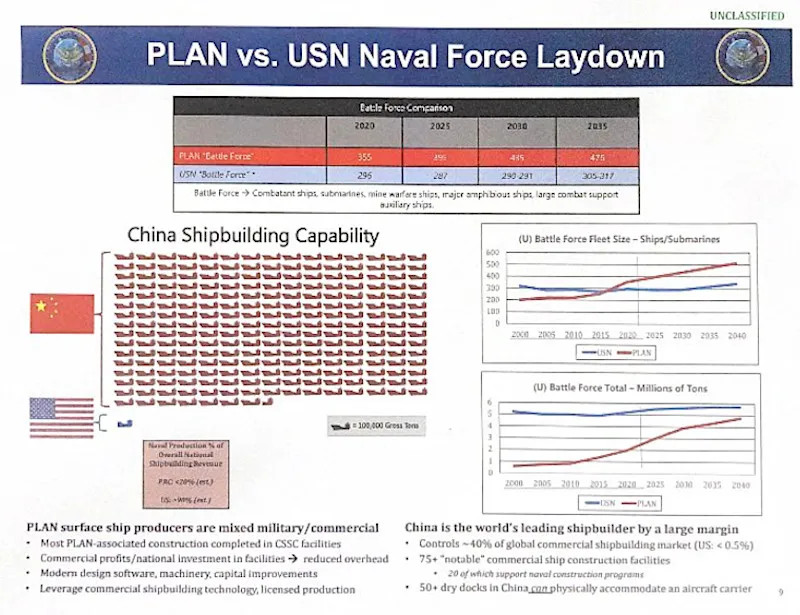

“A war with China in the Taiwan Strait would look nothing like what we’ve seen in Ukraine or the Middle East. Wargames within DoD and military experts are in agreement that the most useful weapons in such a conflict would be long-range anti-ship weapons or cruise missiles,” Ares notes in a section titled “Why we’re doing this” in yesterday’s press release. “The United States is not adequately prepared. In a potential conflict, our stockpiles will run out in weeks, and we currently don’t have the industrial capacity to build at a rate that could win a war, much less deter China.”

“When the US invaded Iraq in 2003, we launched 800 Tomahawks,” Jared Friedman, a partner at Y Combinator, wrote separately in a series of posts about Ares on X yesterday. “At today’s production rate, that would take us a decade to replenish.”

U.S. military operations to protect commercial shipping and friendly warships in and around the Red Sea since October 2023, as well as the defense of Israel against Iran’s missile and drone strikes in April, have given new emphasis to concerns about munitions expenditure rates and the industrial capacity to replenish those stockpiles. The ships assigned to the Dwight D. Eisenhower Carrier Strike Group notably fired 153 Tomahawks while operating around the Red Sea between November 2023 and June 2024. At the same time, the Navy only has plans to buy 181 of those missiles over the next five years, according to its proposed budget for the upcoming 2025 fiscal cycle.

Furthermore, “recent conflicts in the Middle East and Ukraine have shown that our weapons are too large, too expensive for the wars of today. Existing anti-ship cruise missiles are low-volume, multi-million dollar, 3,000 lb behemoths meant to take out large cruisers and destroyers,” Ares release continues. “But Chinese shipbuilding capability is far superior to ours, and we can’t make enough anti-ship missiles to counter. In addition, huge missiles aren’t needed to take out the smaller corvettes and frigates that make up the People’s Liberation Army Navy. And $3M missiles make even less sense to take out swarms of $200k small, unmanned surface vessels.”

The War Zone has previously explored in detail the worrying disparity between U.S. and Chinese shipbuilding capacity, as well as the game-changing impact that swarms of uncrewed systems in the air and down below are likely to have on both sides of any future Taiwan crisis. U.S. officials have now publicly said that a key component of plans to help defend the island from an invasion from the mainland revolves around creating a “hellscape” for Chinese forces full of uncrewed aerial systems, boats, and underwater vehicles, as you can read more about here.

Not highlighted in Ares’ release are the ever-growing anti-access and area denial threats U.S. forces will face in any future high-end conflict against a neer-pear competitor, especially one against China in the Pacific. This, in turn, has been driving additional demand for new and improved stand-off strike capabilities like cruise missiles, and more of them. When it comes to air-launched munitions, specifically, interest has also grown in more compact designs that can fit inside internal weapons bays on stealthy aircraft, giving them improved strike capabilities and capacity while still being able to fly in the more low-observable configurations.

In any high-end fight against the People’s Liberation Army, the U.S. military could expect to be tasked with prosecuting tens of thousands of targets across a broad area. At the same time, not all of those targets would require the use of higher-end munitions like LRASM or the members of the AGM-158 Joint Air-to-Surface Standoff Missile (JASSM) family of land-attack cruise missiles from which it is derived.

The U.S. military is not unaware of these issues and multiple branches have been actively exploring new lower-cost cruise missile concepts and related technology developments for years now in response to this reality. Just in June, the Pentagon’s Defense Innovation Unit (DIU), in cooperation with the U.S. Air Force, announced that it had picked four companies to build and demonstrate so-called “Enterprise Test Vehicles” (ETV) that could be stepping stones to cheaper cruise missiles, as well as lower-cost platforms for launching electronic warfare attacks or to act as decoys. Since then, the ETV effort has also emerged as a prime example of how America’s armed forces are also looking to push beyond traditional defense companies to meet its demands not just for new munitions designs, but also the capacity to build those weapons in useful numbers.

A key component of the ETV project is exploring ways “to expand our industrial base into non-traditional suppliers that perhaps have not historically been large-scale munitions producers,” Vice Chief of Staff of the U.S. Air Force Gen. James Slife explained during a virtual talk that the Air & Space Forces Association’s Mitchell Institute for Aerospace Studies hosted in July. “If the manufacturing techniques we’re able to leverage pan out we’ll be able to take advantage of a bigger part of the American industrial base to produce munitions for us.”

At another Mitchell Institute event in July, Tim Grayson, Special Assistant to Secretary of the Air Force Frank Kendall, disclosed that the Air Force is now working on a new Affordable Mass Munition concept, which sounds similar in many respects to the ETV effort.

“People… were thinking about how we do a better job of applying digital engineering and said you know, ‘if we built a software programmable, modular, but recoverable air vehicle that looks a lot like a missile and flies over most of the missile envelope that could greatly accelerate how we do test[ing],” Grayson said. “And it was sort of like chocolate and peanut butter coming together. …this modular thing for testing purposes, it’s very adaptable, one of the modules is a warhead, sure looks like a low-cost cruise missile.”

New, lower-cost, longer-range strike capabilities to engage threats at sea and on land are of growing interest to the U.S. Navy, the U.S. Marine Corps, and the U.S. Army, as well.

In addition, the need to not just accelerate the development of new munitions and other weapon systems, but also their production, all while keeping costs as low as possible, is becoming a more common topic of discussion across the Department of Defense. Currently, it can take years to go from a contract award to the production and delivery of higher-end weapons due to factors like needing to order system-specific high-tech parts.

In addition to cruise missile programs, this has been particularly apparent in relation to uncrewed systems. The Pentagon’s Replicator initiative, which has a goal of helping America’s armed forces field thousands of uncrewed systems with autonomous capabilities in 2025, is a prime example of this growing trend.

Helping to support foreign partners faced with similar demands for affordable stand-off strike capacity, as well as leveraging industrial capacity in those countries to help meet U.S. needs, are part of this equation, too. It emerged in July that the Air Force’s Extended Range Attack Munition (ERAM) effort is focused primarily on delivering that capability – a precision air-launched 500-pound-class weapon with a projected range of around 250 miles – to Ukraine.

Defense contractors, large and small, are clearly taking note. Anduril, which has become something of a poster child for new entrants into the U.S. defense sector, unveiled plans for a novel “hyperscale” production facility and accompanying manifesto about its vision for the future when it comes to affordable and scalable manufacturing earlier this month, as you can learn more about here.

Much remains to be learned about Ares Industries’ new cruise missile and the company’s broader plans. At the same time, it reflects a clear and still growing demand signal from the U.S. military for new lower-cost stand-off strike capacities, as well as interest in expanding the available industrial base to produce those munitions at scale.

Together with the backing from Y Combinator, Ares’ arrival on the scene looks to be a sign of broader things to come in the U.S. defense sector.

Contact the author: joe@twz.com