The U.S. Army has chosen the Sierra Nevada Corporation (SNC) to lead the conversion of Bombardier Global 6500 business jets into new High Accuracy Detection and Exploitation System (HADES) aircraft. HADES is set to give the service a new crewed fixed-wing aerial intelligence-gathering capability that can fly higher, faster, further, and for longer with a greater payload of sensors than its existing turboprop types.

SNC’s initial HADES contract award is valued at $93.5 million, but the Army says the full 12-year indefinite-delivery, indefinite-quantity deal has an overall ceiling of $991.3 million, according to an official press release. How many HADES aircraft SNC is now on contract to convert is unclear, but the service has said it plans to ultimately acquire a fleet of at least 14 jets, and potentially as many as 16, in the past.

The Army had already chosen the Bombardier Global 6500 as the base aircraft for HADES platform back in January. A team comprised of L3Harris, Leidos, and MAG Aerospace had been competing against SNC for the lead integrator contract.

“HADES is the centerpiece of the Army’s long-promised aerial ISR transformation strategy,” Army Lt. Gen. Anthony Hale, Deputy Chief of Staff for Intelligence, or G-2, also said. “HADES allows the Army to fly higher, faster, and farther, which directly impacts our ability to see and sense deeper, delivering an organic capability in line with the Secretary of the Army’s number-one operational imperative – deep sensing.”

HADES’ range and speed will allow it to get to and from operating areas further away faster, as well as give it greater on-station time and the ability to be retasked more rapidly from one place to another. All of this could be particularly important in operations across the broad expanses of the Pacific region. Being able to fly higher gives the places sensors a better perch to ‘see’ from, too. The Army has also presented HADES’ capabilities in the past as helping to make it less vulnerable to ever-growing air defense threats, especially ones that could be encountered in a future high-end fight against a near-peer competitor like China, than its existing turboprop intelligence, surveillance, and reconnaissance (ISR) fleets.

“I am very proud of the entire HADES team, along with our intelligence, aviation and contracting enterprise partners, who have worked diligently to ensure that the Army delivers a new aerial ISR collection capability that meets the Army’s 2030 operational imperatives,” Army Brig. Gen. David Phillips, head of the service’s Program Executive Office for Aviation, said in a statement. “HADES will allow our formations to see and sense farther and more persistently, providing an asymmetric advantage over our adversaries in large-scale operations and multidomain operations.”

HADES’ deep-sensing capability will be provided at least in part by Raytheon’s Advanced Synthetic Aperture Radar System-2B (ASARS-2B). Development of active electronically-scanned array (AESA) ASARS-2B began first as an upgrade for the U.S. Air Force’s U-2 Dragon Lady spy planes.

ASARS-2B is capable of producing synthetic aperture radar (SAR) imagery, which are highly-detailed ground maps, even through cloud cover, smoke, or dust down below, as well as at night. In addition, it has a ground moving target indicator (GMTI) functionality that can be used to spot and track the movement of vehicles, data that can be further exploited for various intelligence purposes, including targeting and mapping out so-called “patterns of life” in a particular area. GMTI data combined with SAR imagery can help provide further refined intelligence insights.

What else might be included in HADES’ full sensor suite is currently unknown. Crewed aircraft in the Army’s current fixed-wing intelligence, surveillance, and reconnaissance fleets carry a variety of radars, electro-optical and infrared cameras, and signals intelligence (SIGINT) systems.

RC-12 Guardrail Common Sensor (GRCS), MC-12S Enhanced Medium Altitude Reconnaissance and Surveillance System (EMARSS), and EO-5C Airborne Reconnaissance Low-Multi-sensor aircraft are the Army’s main crewed fixed-wing ISR platforms today. The RC-12s and MC-12s are conversions of twin-engine turboprop Beechcraft King Air variants, while the EO-5Cs were converted from Dash-7 de Havilland Canada DHC-7 four-engine turboprops. In 2022, the Army axed its fleet of turboprop de Havilland Canada Dash-8-based Airborne Reconnaissance Low-Enhanced (ARL-E) planes, designated RO-6As. The service has also been moving to retire at least a portion of the EMARSS aircraft already.

Ahead of the arrival of the HADES aircraft, the Army has also been using a mixture of contractor-owned and operated ISR-configured business jets. There is the possibility that some of those jets, especially ones based on the Global 6500, might end up absorbed into the HADES fleet in the future. The U.S. Air Force is also already flying E-11 Battlefield Airborne Communications Node (BACN) aircraft converted from Global 6500s.

While HADES will offer improved capabilities and performance over the Army’s other crewed fixed-wing ISR aircraft, questions remain about the potential for a gap in total capacity even if the service buys 16 of the jets. Though not as capable and more vulnerable, the Army’s combined RC-12Xs, MC-12Ss, and EO-5Cs fleets total more than 40 aircraft.

HADES is also still a non-stealthy platform that would face challenges to get within sensors in any future high-end conflict, especially one against a near-peer opponent like China. Similar concerns contributed to the Air Force’s decision not to pursue a direct replacement for its E-8C Joint Surveillance Target Attack Radar System (JSTARS) aircraft. The futures of even much higher-performance aircraft capable of defending themselves better are being questioned in the face of an increasingly capable air defense threat ecosystem.

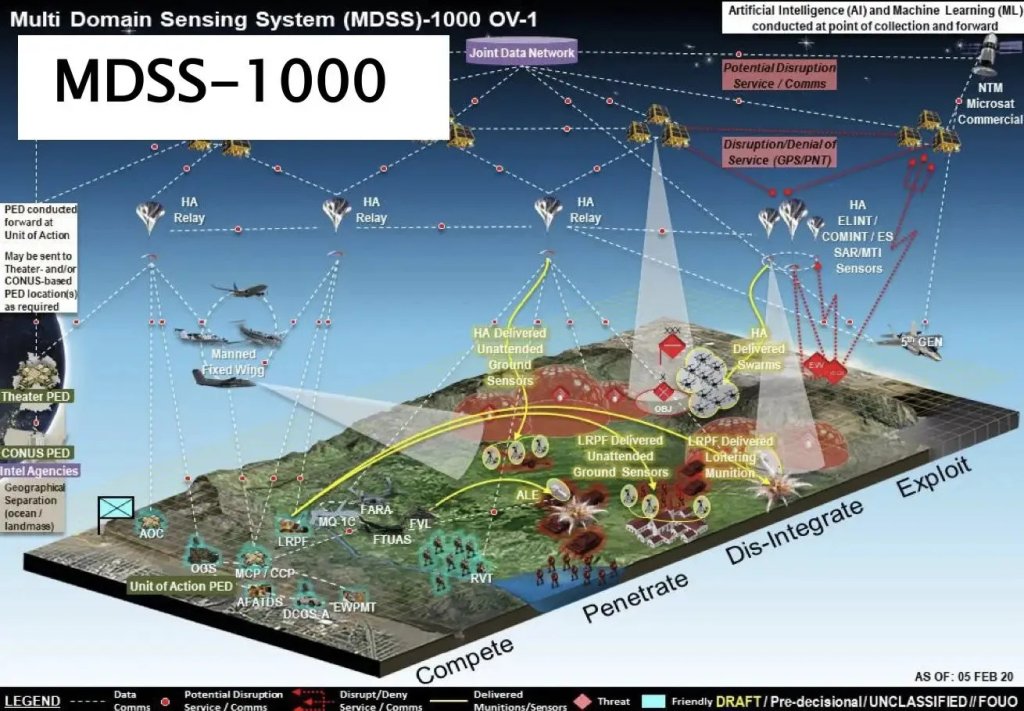

HADES is just one part of a larger vision the Army has for Multi-Domain Sensing System (MDSS) family of systems, which is expected to include multiple uncrewed platforms, including high-altitude glider-like drones and balloons designed to operate up in the stratosphere. It’s unclear when the Army expects to begin taking delivery of HADES jets or any of the other planned MDSS capabilities.

Regardless, it is also worth noting that the HADES contract is a major win for SNC, a company that has become best known for its aircraft modification work. The deal is the second-largest in the company’s history, according to Aviation Week. SNC’s largest contract to date was the one it received from the U.S. Air Force in April to turn second-hand Boeing 747s into Survivable Airborne Operations Center (SAOC) ‘doomsday planes.’ planes, as you can read more about here.

“We have sort of thrived on this underdog role in terms of the entire David vs. Goliath sort of scenarios. However as we’ve stepped up in class, we’ve continued to build capability and to show that we can scale at pace,” Tim Owings, SNC’s Executive Vice President for the company’s Mission Solutions and Technologies business area, told Aviation Week‘s Brian Everstine in an interview that was apparently going on as the HADES contract award was announced. “I think what that’s going to mean going forward is that as we are continually being accepted as a big prime, you’ll see us go after bigger and bigger things.”

“SNC plans to hire 50-100 more personnel at its Hagerstown, Maryland, facility for HADES” and “the aircraft will use sensors the company produces at its Sparks, Nevada, headquarters along with software from a location in North Carolina,” per Everstine’s report.

With the new contract in hand, SNC is now set to help the Army field the next major addition to its fixed-wing ISR fleets.

Contact the author: joe@twz.com