Defense contractor Anduril has unveiled Barracuda, a new family of what it is calling “expendable autonomous air vehicles” that are scalable, highly modular, and already being flight-tested. The company is heavily focused now on “M” versions configured as relatively low-cost air-breathing precision munitions that could be launched from helicopters and fixed-wing aircraft, as well as maritime and ground platforms. A Barracuda type is one of the designs the Pentagon’s Defense Innovation Unit is looking at in its Enterprise Test Vehicle effort, which reflects particularly growing interest within the U.S. military in cheaper and more readily producible cruise missiles and other types of stand-off munitions.

The Barracuda family as it exists now consists of three different core vehicles, the Barracuda-100, Barracuda-250, and Barracuda-500. An “M” configuration is available for each one.

Each tier of Barracuda has roughly the same general layout, with a pair of pop-out wings in the center and folding tail fins at the rear. Conformal intakes built into the bodies of the vehicles feed into their air-breath propulsion systems. Anduril says the top speed of all three existing Barracuda designs, which are powered by small turbojets, is “up to 500 knots” depending on the mode of launch and other factors.

There is a set of core subsystems that are common across all Barracuda types, but they are otherwise intended to be readily reconfigurable. The vehicles are also all designed with an eye toward using “commercially-derived and widely-available components” to help reduce costs and enable the ramping up of production.

The Barracuda-100, the smallest and shortest-ranged version, has a 35-pound payload capacity and projected maximum range of 60 and 85 nautical miles when launched from the surface and the air, respectively, according to Anduril. The company says that this version could be well suited for launch from attack helicopters like the AH-1Z Viper and AH-64 Apache, as well as from Common Launch Tube (CLT) and similar launchers mounted on the rear cargo ramps of AC-130s and other platforms, including ones on the ground.

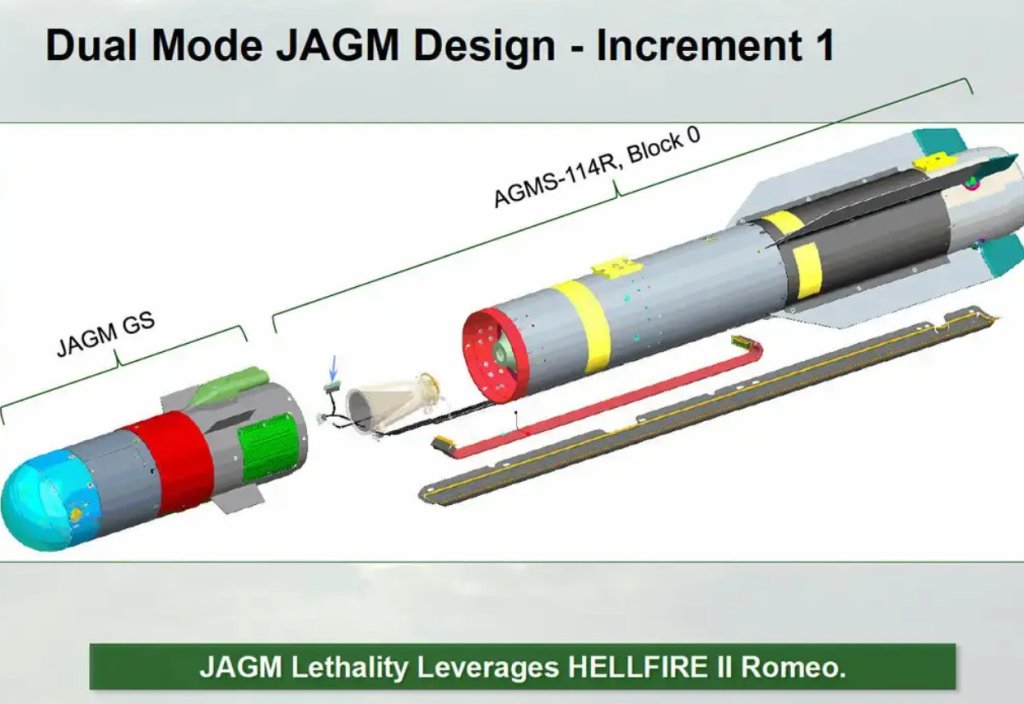

Interestingly, Anduril released an image of an example of a Barracuda-100, seen below, which shows it sporting a connector ‘shoe’ that is very similar to the ones found on AGM-114 Hellfire missiles and AGM-179 Joint Air-to-Ground Missiles (JAGM). For the AGM-114 and AGM-179, the connector provides an interface between the missiles and standard rail-type launchers used on AH-1s, AH-64s, and other helicopters, as well as a host of other platforms, including MQ-9 Reaper drones and AC-130J Ghostrider gunships. The Barracuda-100 is also depicted sitting in front of an AH-1 helicopter and looks to feature some kind of electro-optical, infrared, and/or laser seeker in the nose.

The Barracuda-250 has the same payload capacity as the Barracuda-100, but with a greater expected range – up to 150 and 200 nautical miles for surface and air launch, respectively. Anduril is pitching the 250 version primarily as a potential air-launched store for tactical combat jets and bombers, including as something that could fit inside the bays of stealth fighters like the F-35. The company says it is also something that could possibly be fired from Multiple Launch Rocket System (MLRS) and High Mobility Artillery Rocket System (HIMARS) vehicles on the ground or ships at sea.

Barracuda-500 has a significantly greater payload capacity of up to 100 pounds and is envisioned, at least currently, exclusively for air-launched applications with a maximum range of up to 500 miles. In addition to being employed by combat aircraft, Anduril says that this version could be suitable for use from cargo aircraft via a palletized launch method. The U.S. Air Force is currently developing a palletized launch system like this called Rapid Dragon.

The entire Barracuda-M line is intended to be usable against an array of targets on land and at sea. The company says it is still refining what guidance options it might employ to prosecute those different target sets, which will include ones that are static and moving.

As already noted, Barracuda is one of four designs the Defense Innovation Unit (DIU) selected to take part in its Enterprise Test Vehicle (ETV) effort. DIU is conducting ETV in cooperation with the U.S. Air Force, which sees the designs as stepping stones to a new lower-cost cruise missile. The missile offshoot of ETV is also known as “Franklin,” reportedly a reference to the late singer Aretha Franklin and, specifically, her famous song “Respect.”

However, ETV and Franklin are just two examples of a recent explosion of interest within the U.S. military in new relatively cheap air and surface-launched stand-off munitions the production of which could also be ramped up relatively quickly. American military planners increasingly see lower-cost stand-off weapons as not only valuable, but essential for fighting and winning future wars. U.S. forces would be called upon to prosecute tens of thousands of targets in the opening stages of any high-end fight, especially one in the Pacific against China, and there would be a substantial continued need for munitions if such a conflict were to drag out. Replenishing stockpiles of expended munitions would be critical regardless in order to ensure preparedness for other contingencies. In addition, while lower-cost munitions might also be less capable, they could be used against appropriate target sets to help ensure more capable weapons are available for use in contexts that demand their employment.

“You’re all familiar with the war games, where, you know, the United States and our allies run out of critical munitions in the first week or two of the conflict, and then we struggle, or theoretically would struggle, for a period of years, to replenish all the weapons that we extended,” Chris Brose, Anduril’s Chief Strategy Officer told The War Zone and other outlets. “And I think Ukraine has put that problem in high relief for the past few years on far simpler tactical weapon systems, to say nothing of the larger critical munitions that are going to be so central for an INDOPACOM [U.S. Indo-Pacific Command] scenario.”

Many U.S. allies and partners are taking a similar view, underscored by lessons being drawn from the ongoing conflict in Ukraine. It emerged earlier this year, that the U.S. Air Force’s Extended Range Attack Munition (ERAM) effort is focused primarily on acquiring a lower-cost stand-off aerial strike capability for the Ukrainian Air Force. The U.S. Navy has a similar focus on helping friendly foreign countries acquire new maritime stand-off strike options with what it is calling Coalition Affordable Maritime Strike (CAMS).

Anduril would not name any other programs beyond ETV and Franklin in which Barracuda M versions may be involved, but acknowledged the clear and growing interest on the U.S. side, as well as among potential foreign customers, in munitions of this kind.

“There are other places where Barracuda is making progress” and “we’re seeing a lot of interest from allies and partners,” according to Brose.

Barracudas could also be configured in other ways besides munitions. As The War Zone has noted in the past, there is already an increasingly blurry line between cruise missiles, decoys with electronic warfare payloads, and longer-range kamikaze drones.

“People… were thinking about how we do a better job of applying digital engineering and said you know, ‘if we built a software programmable, modular, but recoverable air vehicle that looks a lot like a missile and flies over most of the missile envelope that could greatly accelerate how we do test[ing],” Tim Grayson, Special Assistant to Secretary of the Air Force Frank Kendall, said during a talk the Air & Space Force Asscoation’s Mitchell Institute hosted in July. “And it was sort of like chocolate and peanut butter coming together. …this modular thing for testing purposes, it’s very adaptable, one of the modules is a warhead, sure looks like a low-cost cruise missile.”

Grayson said at the time the Air Force was referring to the concept he described as the Affordable Mass Munition, which is very much in line with the thinking underpinning both DIU’s ETV effort and Anduril’s Barracuda.

Anduril has itself highlighted the potential for Barracudas to work collaboratively in groups using the company’s propriety Lattice artificial intelligence-enabled autonomy software package, third-party systems, or a mixture of both.

“Undergirding all of what exists inside of Barracuda is the Lattice operating system and the high levels of mission autonomy that that brings. So when we talk about barracuda, and this is kind of inherent in the name, right? It is, it is a capability that is designed to be deployed in groups, you know, to hunt and effect in teams,” Brose explained. “You can, obviously, you know, deliver those effects through a single air vehicle, but the real value of the capability, which is realized both in the high levels of autonomy and the low levels of cost, is the ability to actually deploy these as teams, to go out and do collaborative engagement.”

“There was the question about survivability, countermeasures, and I think… we’re trying to think about this problem differently,” he continued. “You don’t necessarily have to bundle every single piece of capability into a single round or air vehicle. You can also envision how working as a team, multiple air vehicles are capable of collaborating, providing different capabilities, whether it’s target detection, whether it’s decoying or countermeasures, whether it’s strike, so that that package can go deliver the mission effect that you want, without, again, having to bundle all of that into one air vehicle and then radically, drive up the cost per round of every single vehicle.”

What Brose is describing here is an inherent capability offered by fully networked swarms of systems acting as a unified whole. Networked munitions that can work together collaboratively is something the U.S. military has a stated interest in with the U.S. Air Force’s Golden Horde project being a prime example.

The entire Barracuda family and the core design of the vehicles highlight Anduril’s broader vision for disrupting typical development, production, and supply chains, as well as exportability, when it comes to defense programs. The animated promotional video for Barracuda, seen at the top of this story, underscores the company’s consistent push to set itself apart from traditional defense contractors. Founded in 2017, it is still a relative newcomer in the industry, but has been steadily securing more major contracts from the U.S. military and foreign armed forces. It is also been working to significantly grow its own organic production capacity, including a planned “hyperscale” factory in the United States announced earlier this year.

What Anduril is looking to do with Barracuda “is the opposite of what you see in our traditional weapons sector, which are exquisite systems that are incredibly hard to produce, that are limited in their scalability across those programs by highly specialized labor, overly defense-specific supply chains, very complex, bespoke, manual defense-unique manufacturing processes, exquisite materials and the like, such that these systems become incredibly difficult and all but impossible to really produce in the volumes that our operational leaders are saying they’re going to need, which is like a 10x increase in weapons production,” Anduril Brose explained. “These are systems that can be assembled with tools, literally, that you probably have in your garage – screwdrivers, pliers, things of that sort. So it is not gated in terms of its producibility on highly specialized tooling, highly specialized manufacturing processes, highly specialized labor, none of which we’re ever going to have enough of.”

A key aspect of the underlying approach is “I have to leverage commercial supply chains as much as possible. I have to make the weapon as simple to produce and as simple to assemble as possible, so that the broadest possible labor tool can be brought to bear, to scale production,” he continued. “So the ability to tap into commercial automotive… labor pools and related sources of workforce, is how we’re thinking about this system, not just so you can build it in large numbers at low prices to begin with, but if, God forbid, we find ourselves in another protracted conflict where we have to keep that rate manufacturing high over a prolonged period of time, we’re capable of doing that.”

In addition, “you can take it apart like Lego blocks, and it makes it a lot easier to kind of work through and navigate, you know, kind of defense export issues and collaboration with allies,” Brose added.

“A lot of that is keeping it simple. Don’t reduce the number of parts that you need to use. Rely more on commercial components. Reduce the tooling and the complexity of manufacturing. This makes it much more producible, and allows us to kind of rely on infrastructure and manufacturing capabilities and labor forces that isn’t, again, bespoke to just one single system,” Diem Salmon, Vice President of Air Dominance and Strike at Anduril, also told The War Zone and other outlets while speaking alongside Brose. “This also significantly brings the cost down. So less touch labor, etc, if you’re down to, you know, a handful of common tools, rather than having unique tool sets for every single variant of weapon that you’re developing.”

Whether Anduril will be able to make good on its broader vision, through Barracuda or any of the rest of its steadily growing portfolio, remains to be seen. The company has somewhat nebulously said “a single Barracuda takes 50 percent less time to produce, requires 95 percent fewer tools, and 50 percent fewer parts than competing solutions on the market today” and that “the Barracuda family … is 30 percent cheaper on average than other solutions, enabling affordable mass and cost-effective, large-scale employment,” but has so far not provided a direct 1:1 comparison with an existing system. A statement like “30 percent cheaper on average” presents a very broad potential cost range when talking about a multi-tier family of readily reconfigurable systems. Existing in the same general classes can have different price points, as well. For instance, the unit cost of a current-generation AGM-114 Hellfires is around $210,000 to $215,000, while that of a newer AGM-179A JAGM is in the $300,000 to $330,000 range, according to U.S. Army budget documents. A munition in either of those price ranges is much cheaper than something like an AGM-158 Joint Air-to-Surface Standoff Missiles (JASSM) with a unit cost of more than a million dollars.

At the same time, U.S. military officials have been increasingly public about their view that there is a need for expansion in the U.S. defense industrial base and that smaller or otherwise non-traditional companies will play important roles in doing that going forward.

ETV, specifically, presents a path “to expand our industrial base into non-traditional suppliers that perhaps have not historically been large-scale munitions producers,” Vice Chief of Staff of the U.S. Air Force Gen. James Slife said back in July. “If the manufacturing techniques we’re able to leverage pan out we’ll be able to take advantage of a bigger part of the American industrial base to produce munitions for us.”

With this in mind, Anduril faces already stiff and still growing competition when it comes to products like Barracuda. In August, Y Combinator, a powerful Silicon Valley technology incubator, announced it was backing a startup aiming to produce lower-cost cruise missiles in its first-ever foray into the defense sector.

If nothing else, the public debut of the Barracuda family is the latest evidence of bigger trends in the U.S. defense industry that could have ramifications well beyond work on new and cheaper precision munitions.

Contact the author: joe@twz.com